It was not a lazy Sunday when the price of BTC jumped more than 3% with further surge continuing Monday morning.

Bitcoin price climbed 5% with the start of a new week, month, and quarter. The price hit $28,000 in a six-week high as inflows picked up and more than $70M in crypto shorts wiped out.

Bitcoin hit $28,000

It was not a lazy Sunday when the price of BTC jumped more than 3% with further surge continuing Monday morning.

The gain was the highest since August 17.

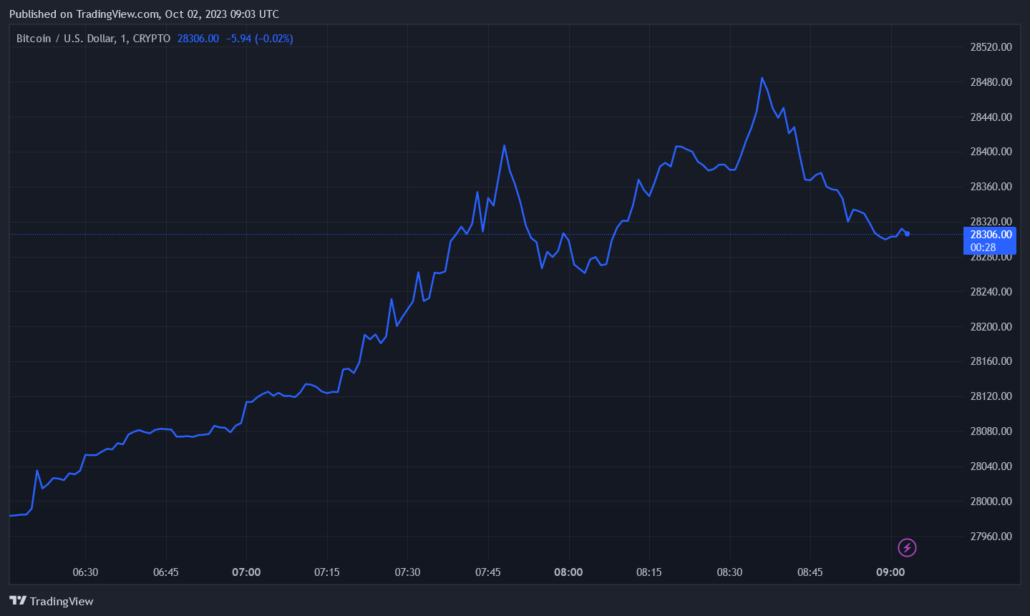

Data from TradingView shows that Bitcoin is currently trading at $28,310, gaining 1.19% in the last 24 hours.

The price increase has been linked to a number of factors including October being a bullish month for Bitcoin and the general market, bullish momentum from spot trading, and a possible grant of ETF applications by the US Securities and Exchange Commission (SEC).

Uptober?

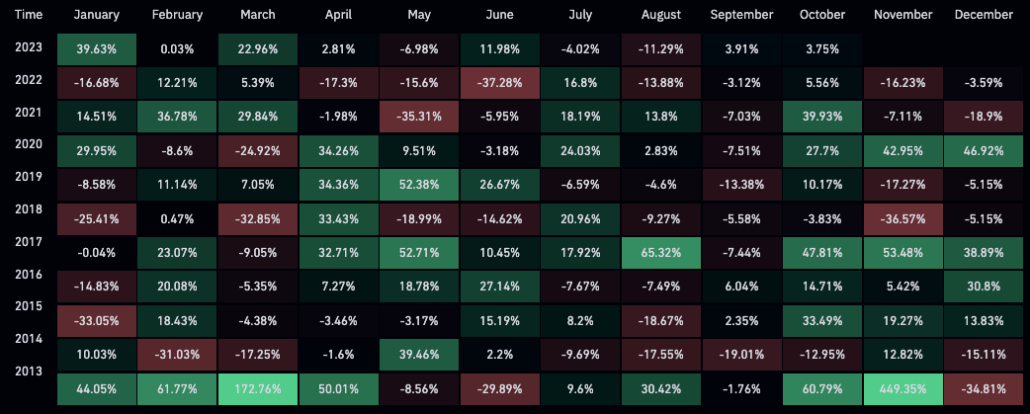

In contrast to last year, Bitcoin started the month on a positive note comparable to previous Octobers.

Data from CoinGlass showed that the price has not finished October lower than it started since 2018. And October has only produced negative monthly returns twice since 2013.

Bullish spot trading and short squeeze

Another primary catalyst behind the surge is the bullish momentum by spot traders. BTC hit $28,141 at Asian trading time on Monday morning and has continued to trend upwards.

Greeks Live commented that the rally was spot trading driven, saying: “With current market liquidity, spot buying of a few thousand bitcoins is enough to steadily support the entire market up a price step.”

Short squeeze on futures trading saw a staggering $392M in short positions, or an estimated 7.7% of the total open interest in the market, swiftly wiped out.

The sudden jump in price also liquidated $36M worth of BTC shorts, according to data from CoinGlass.

It’s important to note that at this point two things are important to the market: whether spot traders will continue to enter the market due to FOMO or whether short sellers decode to re-establish their positions.

ETF applications

Despite delays, optimism has continued to gather on the possibility of the SEC granting the several spot Bitcoin applications on its table.

As lawmakers continue to pressure the regulator, there appears to be some glimmer of hope that this quarter may see some approvals, especially for BlackRock, Fidelity, and other early applicants.

Disclaimer: CryptoPlug does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.