Bitcoin poised for first recession

Bitcoin price may be facing its first recession in the United States and is due for volatility.

Analysts have noted that the BTC should prepare for macro-fueled price action following US regulators’ recent suits against the crypto exchanges.

Bitcoin price volatility show low volatility

Bitcoin has maintained low volatility following the SEC cracking down on different players in the US crypto space.

Despite significant price swings in response to the U.S. Securities and Exchange Commission’s (SEC) lawsuits against Binance and Coinbase, the price of bitcoin fell 1.5% week-to-date to about $26,690.

In the last 24 hours, the pioneer cryptocurrency has traded in the range of $26,344 and $26,753. During this time, the volumes have been over $11B.

The day-to-day price movement of the coin have not offered a decisive trend up or down. And $30k remains almost unreachable in the near-term. At the time of report, the price was trading at $26,492.

Top market strategist, Mike McGlone, has noted that Bitcoin price performance implications appear to be leaning unfavourably toward the second quarter, which ends this month.

The analysis demonstrates that gold may shine in the event of a full-fledged recession as it has historically done, a development that, if it occurs, may not favor BTC due to its status as a risk asset.

Since there is so much ambiguity around the asset, it may be challenging to anticipate the exact performance of the digital currency. However, it is important to note that since the year’s beginning, Bitcoin has managed to fend off some of the market’s negative sentiments.

Read more: Bitcoin price drops as liquidity falters in the wake of regulatory tussle

QCP capital says SEC is trigger-happy

In its recent market update, QCP capital has told investors to watch out for macro-fueled price action in the coming days.

The firm believes that more unfavourable events will occur in the crypto space over the next few weeks. Though, regulatory battles won’t cause a significant fall in the price of Bitcoin.

“Once again trigger-happy Gensler and his SEC cronies wielded their ‘securities’ threat on their favourite whipping industry. However as we have maintained before, BTC/ETH will continue to treat the SEC as a toothless adversary – especially as it becomes crystal clear that the term ‘security’ will not apply to either,” it wrote.

“As more and more such far-fetched SEC complaints are filed, it becomes increasingly clear all they are seeking are sensational headlines leading to a final fat settlement. After all, Gensler has proven the most capitalist of all previous regulators.”

The firm did note that if the US Department of Justice and its other arms were to get involved, the regulatory tussle will become more intense and may affect the general crypto market.

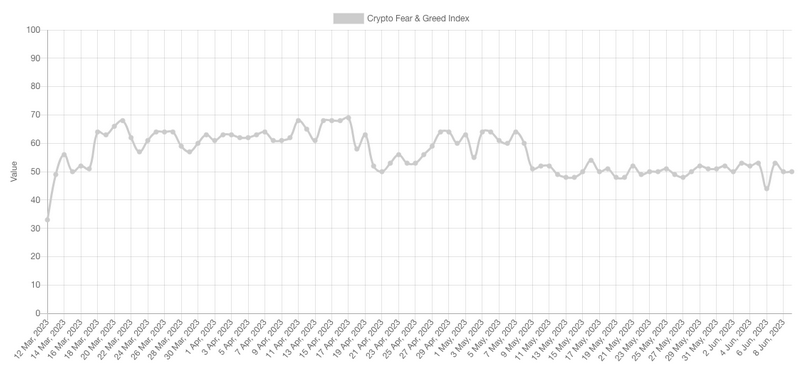

Since the SEC lawsuit against Binance and Coinbase was announced, the crypto Fear and Greed Index have stayed on the “neutral” territory (50/100), indicating that investors are not sure of what steps to take yet.

Disclaimer: CryptoPlug does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.