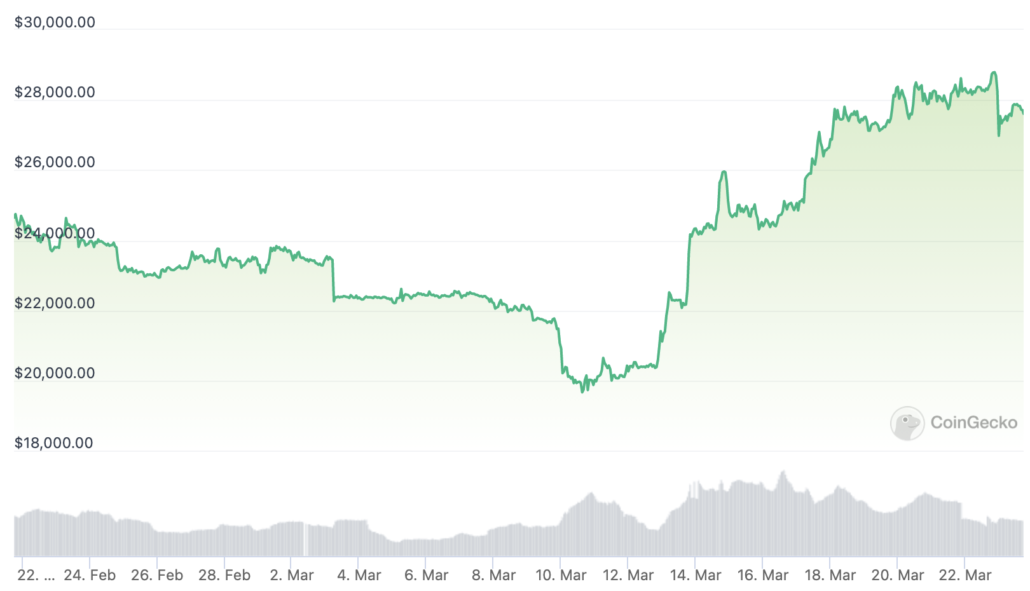

Bitcoin has enjoyed a 70% rally since January in spite of banking meltdowns.

At the beginning of 2023, bitcoin hovered around the $16,000 mark, following a particularly frosty 2022. At the time of writing, bitcoin has recovered to around $28,000, marking a 75% increase from early January.

Despite the challenges thrown at the worlds most valuable crypto, it has shown great resilience this year, even while the banks surrounding it appear to have fallen like dominoes. The recent price surge has sparked hopes that this unseasonably chilly crypto-winter is finally coming to an end.

Read more: Signature Bank closed due to a “crisis of confidence”, not because of its ties to crypto

There are several explanations behind this week’s bitcoin rally, most notably: banking meltdowns.

Several major banks have collapsed over the past two weeks, crushing consumer confidence in the traditional financial system. On March 8, crypto-friendly Silvergate bank announced it would be winding down and “voluntarily liquidating” following regulatory clamp-downs. Two days later, Silicon Valley Bank collapsed following a social-media fuelled bank run, marking the biggest bank failure since 2008. Another two days later, in what felt like a falling house of cards, Signature Bank shuttered, with regulators citing a “crisis of confidence” in the bank’s balance sheets.

Bitcoin was created in response to the 2008 financial crisis – a period which had a profound impact on the global economy, leading to a significant contraction in economic activity and widespread job losses around the world. As a decentralised network with a fixed supply, Bitcoin aims to protect investors from the limitations of inflationary fiat currency and spontaneous institution collapses.

While cryptocurrency remains too volatile to be a reliable hedge, volatility will likely calm as the market matures.

As Stéphane Ouellette, CEO at digital asset investment platform FRNT Financial, told Reuters: “If you were going to describe an environment where there were successive bank runs because central banks are trying to fight inflation with fast rate increases, that is pretty close to as spot-on a thesis for owning bitcoin as you’ve ever heard.”

It’s important to observe that while bitcoin has rallied, other other currencies have suffered, such as USDC – a stablecoin that’s pegged to the dollar.

Good to know

A stablecoin is a type of cryptocurrency that is designed to maintain a stable value relative to another asset, such as a fiat currency like the US dollar or the euro. Stablecoins that are tied to fiat currencies are backed by a reserve of that currency, which is held by the issuer of the stablecoin. USDT, USDC and BUSD are popular stablecoins.

Circle USDC, the second largest stablecoin by market cap, lost its 1:1 peg to the dollar after revealing that its reserves were held at Silicon Valley Bank.

Spooked investors rushed to withdraw their USDC, sliding the market cap from $43.8 billion to $36.8 billion within a week.

Bitcoin may still be 40% down from its all-time high of $65,000, but this week’s rally proves at least one thing: when confidence in banks fail, investors turn to bitcoin – precisely as intended.