Some two dozen central banks across emerging and advanced economies to launch CBDCs

CBDCs are here to stay. A new survey has revealed that Central Bank Digital Currencies (CBDCs) show no sign of waning.

The report noted that about 2 dozen central banks should have launched their pilot digital currencies by 2030.

CBDs are here to stay

The Bank of International Settlements (BIS) published a new report on July 10 that surveyed 86 central banks. The survey which was conducted between late October to December 2022 reveals interesting developments concerning CBDCs.

According to the report, 93% of the central banks are already experimenting and conducting research on CBDCs. 68% are not ready to launch. By these numbers, there could be up to 15 retail and 9 wholesale CBDCs in circulation by 2030.

The survey revealed that more than half of the world’s central banks are researching or working on their CBDCs pilot projects.

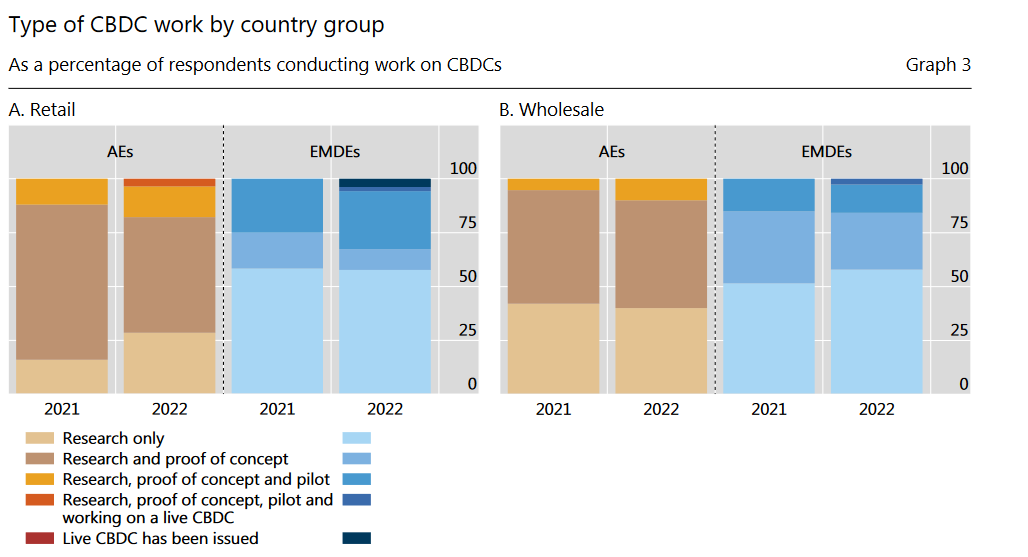

The 93% increase in banks in some CBDC work is a 3% rise from last year figures which stood at 90%. It also shows that the work on retail CBDC is more advanced than wholesale CBDC.

Read more: UK bill empowering authorities to seize crypto is on track to become law very soon

More countries to launch

Geographically speaking, the countries in emerging markets and developing economies (EMDEs) are driving the implementation of CBDCs. They are nearly twice as involved in the development of the retail (29%) and wholesale (16%) CBDCs as the advanced economies (AEs), whose respective shares are 18% and 10%.

According to the BIS’ survey, the majority of the new central bank digital currencies (CBDCs) will appear in the retail sector, where eleven central banks could join peers in the Bahamas, the Eastern Caribbean, Jamaica, and Nigeria that already operate live digital retail currencies.

“Enhancing cross-border payments is among the key drivers of central banks’ work on wholesale CBDCs,” the authors of the report wrote.

Nine central banks may establish CBDCs on the wholesale side, which in the future may enable financial institutions to access new functions due to tokenisation, according to the BIS.

Late last month, the Indian Reserve Bank said it was in an ongoing negotiations with at least 18 central banks globally concerning the possibility of cross-border payments using it’s CBDC, the digital rupee.

In the same vein, the Swiss National Bank announced that it will issue wholesale CBDC on the Switzerland digital exchange as part of a pilot, while the European Central Bank is about to launch its own pilot.

Disclaimer: CryptoPlug does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.