CPI inflation fell slightly below the economist forecast of 5.0%, driving Bitcoin back up to $28k.

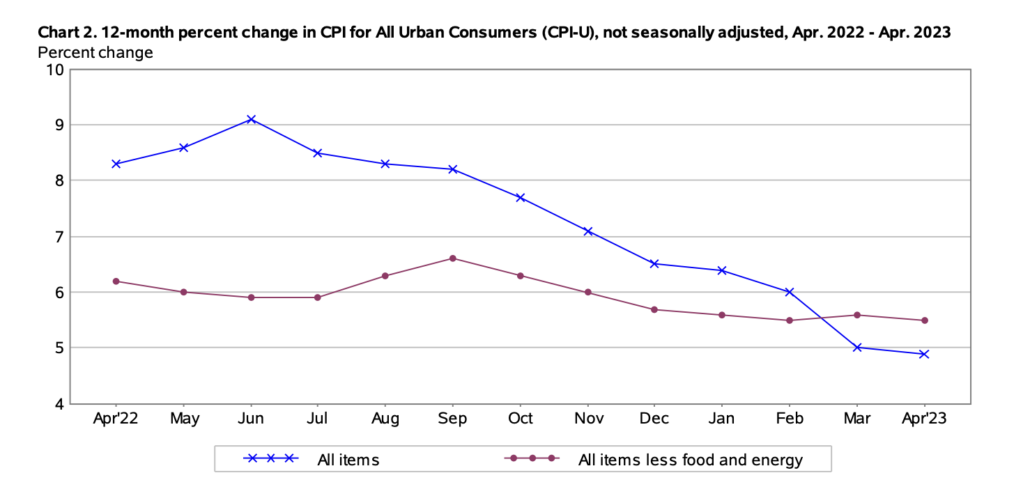

US CPI inflation fell to 4.9% from 5.0% in April, the Bureau of Labor Statistics (BLS) has revealed, beating economist forecasts of 5.0%. The announcement had an immediate impact on the price of Bitcoin (BTC), which rose over 1% to above $28,000 moments after.

This reaction is in line with previous observations of Bitcoin responding positively to inflationary economic news.

The annual core CPI, which excludes the volatile sectors of food and energy, met expectations with a 5.5% year-on-year increase, compared with March’s 5.6%.

Other key takeaways from the report:

- The largest contributor to the monthly all items increase was the index for shelter, followed by used cars and trucks and gasoline.

- The food index was unchanged in April, while the index for food at home fell by 0.2 percent and the index for food away from home rose by 0.4 percent.

- The energy index decreased by 5.1 percent for the 12 months ending in April, and the food index increased by 7.7 percent over the last year.

The US Federal Reserve’s Federal Open Market Committee (FOMC) has hinted that it’s considering pausing the run of rate increases that have taken its benchmark overnight interest rates from about 0% in early 2022 to the current range of 5.0%-5.25%.

Regarding the end-point of rate increases, Fed Chair Jerome Powell optimistically stated: “We’re closer, or maybe even there.”

Despite the rapid pace of rate hikes, the central bank has not yet succeeded in bringing inflation down to its target of 2%.

The May CPI report is expected to be closely watched by investors as they try to gauge the direction of the US economy and its impact on the cryptocurrency market, particularly in light of the ongoing banking crisis.

Disclaimer: CryptoPlug does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.