MicroStrategy reported it bought an additional 467 bitcoin.

Microstrategy, the enterprise-software maker published its second quarter earnings report today. The report shows that the company returned to profitability after facing a steady decline in recent quarters following Bitcoin plunging during the crypto winter.

Microstrategy returns to profitability

Microstrategy, the largest publicly traded business intelligence company announced its financial results for the three-month period ended June 30, the second quarter of the year.

With an average Bitcoin price of $28,233 since the first quarter of 2023, the company has purchased 12,800 BTC for $361.4M. The price of MicroStrategy shares increased by 200% during the same time frame. In terms of its core business, MicroStrategy had a 4% increase in revenue from software licenses year over year while seeing a 42% increase in revenue from subscription services.

In comparison to the same period last year, when the company lost more than $1B, or $94 per share, it earned net profits of $22.2M, or $1.54 per share in the last 3 months. The company, missed Wall Street’s revenue projections, with revenues falling 1.4% to $120.4M.

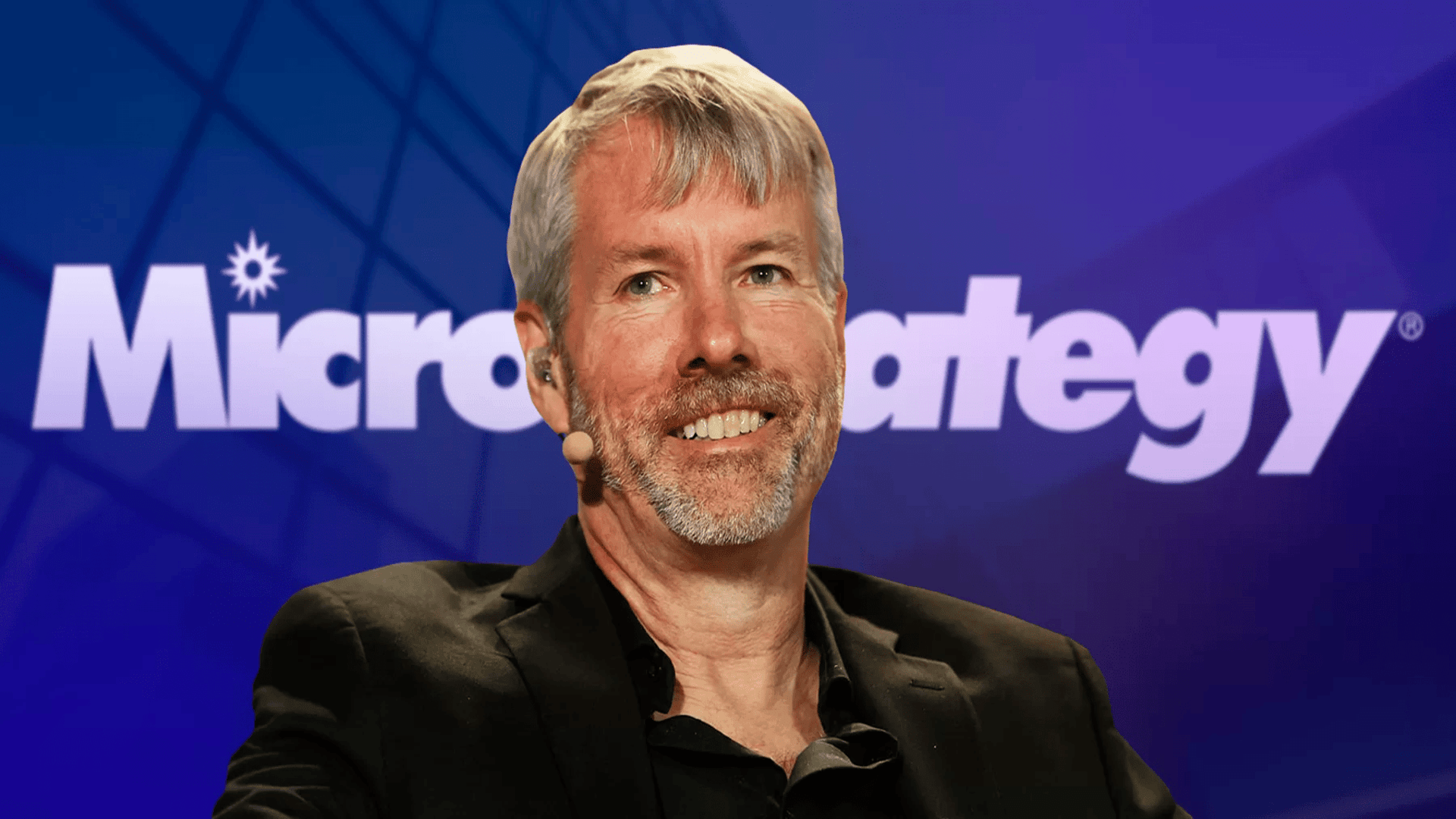

The Michael Saylor software firm known for its bullish bets on Bitcoin said it acquired another 467 BTC as it released its second quarter earnings on Tuesday. This follows a previous acquisition of $361.4M in Bitcoin during the second quarter, the largest purchase by the company since Bitcoin price peaked in late 2021.

The new acquisition brings the company’s total stash to 152,000 Bitcoin, or about $4.5B.

Read more: Crypto.com registers in Netherlands, trumping Binance and Coinbase

ETF filings may shake position

Microstrategy began buying BTC in 2020, with the vision that holding the pioneer cryptocurrency will help the company hedge against inflation.

The move to acquire Bitcoin has solidified the company’s position as the world’s largest institutional holder of BTC. It’s expected that this position may be shaken soon if the US Securities and Exchange Commission grants the spot Bitcoin ETF applications that have been made in the past few weeks.

Andrew Kang, the Chief Financial Officer at the company, said the BTC accumulation continued in recent times “Despite promising backdrop of increasing institutional interest, progress on accounting transparency, and ongoing regulatory clarity for Bitcoin.”

Disclaimer: CryptoPlug does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.