Opensea is caving into pressure from its competitors to kill royalties.

NFT marketplace OpenSea has announced that it will be making creator fees optional for new collections launched from September 2023.

The news has been met with lot of criticisms.

OpenSea breaks the NFT market

In a new move that has shocked the NFT market, popular NFT marketplace has announced that it will soon stop enforcing creator royalty fee on secondary sales of NFTs on its platform.

The marketplace said that after August 31, it will disable its operator filter, a tool that enforced royalties for creators. From March 2024, the royalties will become tips—a percentage of sale price that sellers are at will to give the original creator.

The Operator Filter, which was first introduced in November 2022, was a code snippet to limit NFT sales exclusively to marketplaces that upheld creator fees. But this quickly lost relevance as some NFT platforms bypassed the code and the ecosystem paid it no mind.

Platforms like Blur, Dew, and LooksRare bypassed the Filter and integrated the Seaport Protocol, essentially evading creator fees and OpenSea’s blacklist.

“To be clear, creator fees aren’t going away – simply the ineffective, unilateral enforcement of them,” OpenSea wrote.

They added: “In November 2022, we launched the Operator Filter: a tool designed to give creators more control by restricting the sale of their collections to web3 marketplaces that enforce creator fees in secondary sales. It was meant to empower creators with greater control over their web3 business models, but it required the buy-in of everyone in the web3 ecosystem, and unfortunately that has not happened.”

Read more: NFT royalty earnings: Yuga Labs and RTFKT take highest profits, Chiru Labs a close third

Market dominance in a free market

The market has gone agog since the announcement because one of the big promises of NFTs was that artists and creators could get perpetual royalties on their work.

Following X2Y2’s 0% creator royalty fees experiment in February 2022, it became a debate whether royalty payments were necessary. OpenSea stood with creators, enforcing royalty fees up to 10%. But as soon as tension mounted from the Blur platform, OpenSea reduced its fees.

Blur’s free market approach upended OpenSea’s market dominance. In February, the platform took over from Opensea as the largest NFT marketplace by trading volume.

SuperRare’s CEO John Crain lambasted the decision by OpenSea, emphasizing the importance of royalty fees in the NFT ecosystem.

“Royalties on secondary sales are fundamental to the NFT art revolution… [and] core to artist sovereignty, and the future of this movement,” John said in a statement. “It’s unfortunate to see a trend going back on this as an industry.”

Apart from the fight for royalty fees, OpenSea takes a 2.5% platform fee for every NFT transaction. Blur collects nothing. This makes it a preference for some creators.

A shrinking market

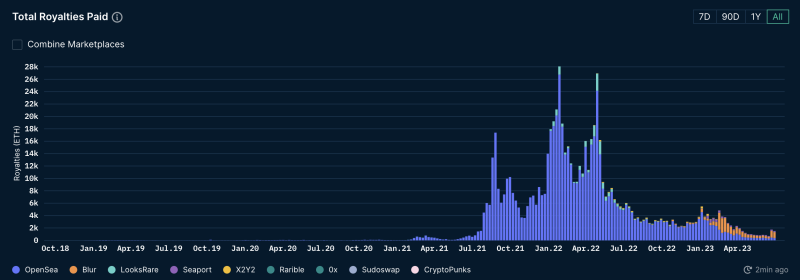

In addition, the NFT market has been on steady decline. NFT royalties had hit the lowest volumes in two years by July 5. Also, trading volumes have fallen to really low levels.

“Something to consider is that I believe OpenSea have reacted with this decision due to seeing a huge drop off in volume,” Drunken Monkey Members Club Founder Gavin Berry, said in a statement. “But this is short-sighted and a market-wide depression within the NFT downturn, with sales being way, way under their weekly-high of trading volume set in April/May 2022,”,

DappRadar noted that OpenSea generated only $82M in trading volume last month, while Blur had a trading volume of $271M. In March, the figures were $424M and $1.35B, respectively. On the weekly chart, Blur has netted $73.7M in trading volume, while OpenSea only traded $19.68M.

“They should be working on education and solutions to drive adoption, not stifling growth from those that have made OpenSea what they are today,” Gavin added.

Despite the negative sentiments around the announcement, some are optimistic that the move might be the way to stop the NFT business model of profiting off hype trading.

Devin Finzer, CEO of OpenSea, decried the “ineffective, unilateral enforcement” of the fees and said that creators will find alternative ways to make money from their work.

Disclaimer: CryptoPlug does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.