The SEC’s charge against Stoner Cats is arbitrary and actively hostile toward Web3 creators who rely on alternative methods of funding.

The US Securities and Exchange Commission (SEC) is clear on one thing: it does not like crypto. The Commission’s new ruling against Stoner Cats however marks a new and arbitrary low point that has the potential to wreak havoc on the financial viability of many creative projects.

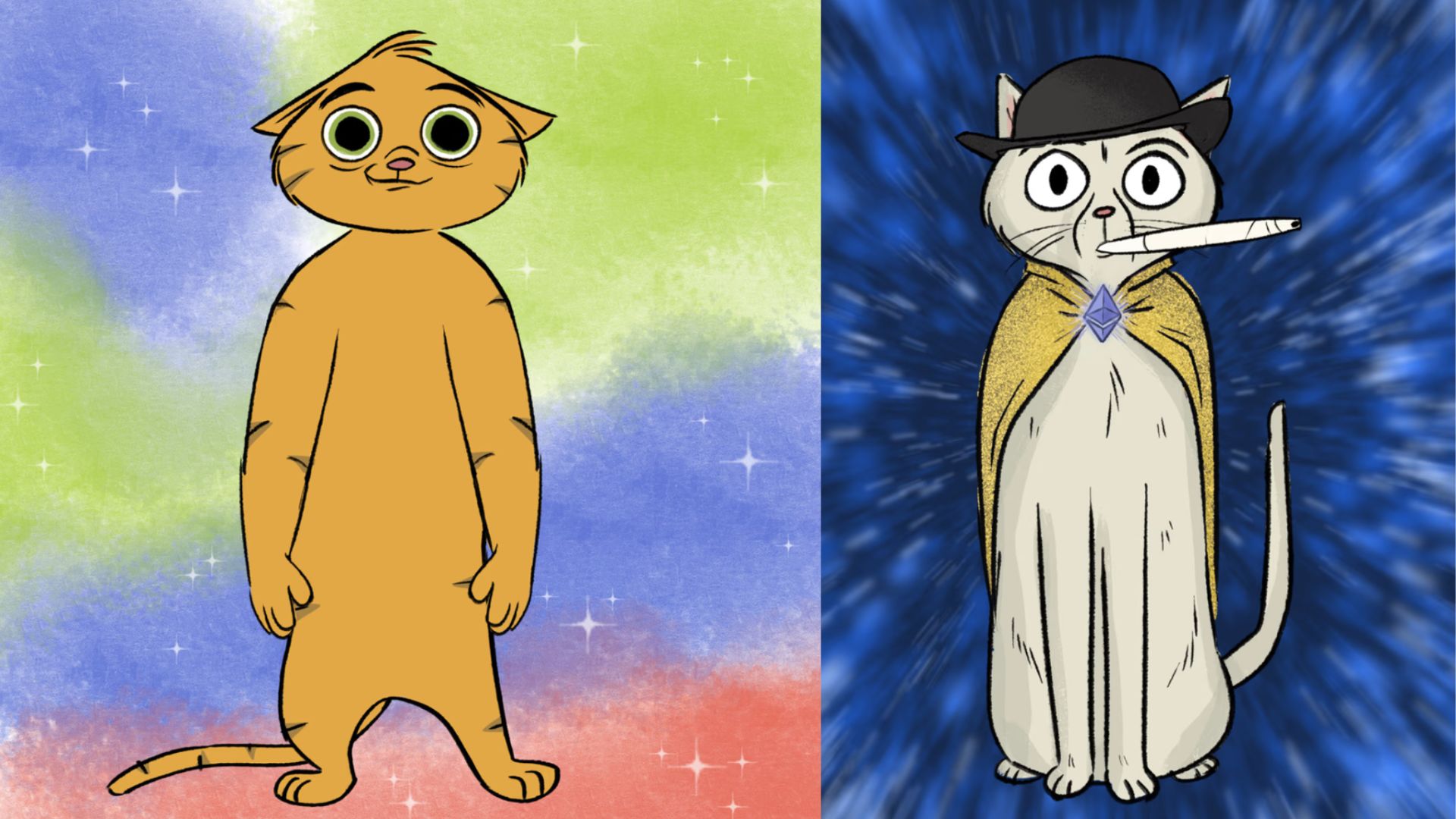

Stoner Cats is an animated show about house cats that become sentient after being exposed to their owner’s medical cannabis, which is used to treat early symptoms of Alzheimers. It has a star-studded cast, featuring Mila Kunis, Ashton Kutcher, Jane Fonda, Chris Rock, and even Ethereum co-founder, Vitalik Buterin.

The show was funded by an NFT sale, whereby holders gained exclusive access to the series. The collection featured 10,320 NFTs, each priced at around $800 in Ether with a 2.5% royalty on secondary sales. Unlike many other NFT projects, Stoner Cats actually delivered on their utility, which was access to the six-part series.

The project is a good example of how Web3 can be embraced to establish new and creative ways to fund creators and creative projects, without them having to rely on age-old institutions that no longer serve the financial needs of many creatives.

Read more: SEC charges media company with selling NFTs as securities in landmark case

On September 13, the SEC charged the company behind Stoner Cats – Stoner Cats 2, LLC – with selling NFTs as “unregistered securities”. The company has been slapped with a $1 million fine, and they must set up a Fair Fund to compensate “injured” investors. It must also destroy any remaining Stoner Cats in its possession.

The case is the second time the SEC has ruled that an NFT is a security; the first being wellness media company, Impact Theory.

As part of its justification, the SEC document references memes from the Stoner Cats Twitter account.

Such memes “tout the sales of NFTs in the secondary market and encourage the public to buy them”, the Commission outlined.

“Stoner Cats NFTs are not that different from Star Wars collectibles sold in the 1970s”

SEC Commissioners Hester Peirce and Mark Uyeda both dissented on the charge, as they did in the case of Impact Theory several weeks ago.

Read more: “Crypto mom” SEC Commissioner dissents on landmark NFT case

The Commissioners stated that the application of the Howey analysis – the test for whether an asset is a security – lacks any meaningful principle in this case, carrying broad implications for all kinds of creator.

They wrote, “The Commission’s application of the securities laws here makes little sense and discourages content creators from exploring ways to harness social networks to create and distribute content. More generally, it contributes to the legal ambiguity facing artists, writers, musicians, filmmakers, and others seeking to build a loyal, engaged following.”

The Commissioners acknowledged that artists have “long struggled to support themselves”, and that NFTs offer a potentially viable way for them to monetize their work. “The fact that money is involved does not transform NFTs into securities,” they said.

The dissent likened the sale of the NFTs to “crowdfunding”, which is common in the entertainment industry.

With subtle humour, the Commissioners compared Stoner Cats NFTs to the Star Wars mania of 1977, when the toy company Kenner sold early bird collectibles that could be resold within a community of “die-hard” fans.

“Using the analysis of today’s enforcement action, the SEC should have parachuted in to save those kids from Star Wars mania,” they said.

“Rather than arbitrarily bringing enforcement actions against NFT projects, we ought to lay out some clear guidelines for artists and other creators who want to experiment with NFTs as a way to support their creative efforts and build their fan communities.”

In their dissent of the SEC’s Impact Theory ruling several weeks ago, Commissioners Uyeda and Peirce stressed that the Commission should have offered guidance when NFTs first started proliferating “long ago”.

Disclaimer: CryptoPlug does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.