A shareholder letter issued on May 4 reveals that Q1 was better than many expected, with losses slashed by 86%.

Coinbase remains committed to the US despite regulatory difficulties, a shareholder letter reveals. The numbers in yesterday’s letter reveal a better-than-expected Q1, with the company’s net losses falling from $557 million in Q4 2022 to $79 million in Q1 2023.

The letter also affirms that the exchange remains committed to the US and will continue working to “ensure the regulated, compliant growth of the cryptoeconomy in the US”. The statement comes two weeks after CEO Brian Armstong told former UK Chancellor George Osborne that Coinbase will consider moving to the UK in a few years if US regulators fail to provide clarity.

Read more: Coinbase might be moving its HQ to the UK

Coinbase’s strained relationship with US regulators turned particularly frosty in March after the SEC issued the exchange a Wells notice. A Wells notice typically indicates that the commission is considering recommending enforcement action against a company. Coinbase has since publicly issued their response to the notice, with chief legal officer Paul Grewal stating that “efforts to engage with the SEC are met with silence or enforcement actions.”

What else does the shareholder letter reveal?

Coinbase states that Q1 represents a “turning point” toward financial discipline.

Similar to Meta’s ‘Year of Efficiency’, Coinbase scaled back its team over the past year, cutting staff by 18% in June and 20% in January. The letter states that the company’s teams are now “smaller, but more nimble than ever”.

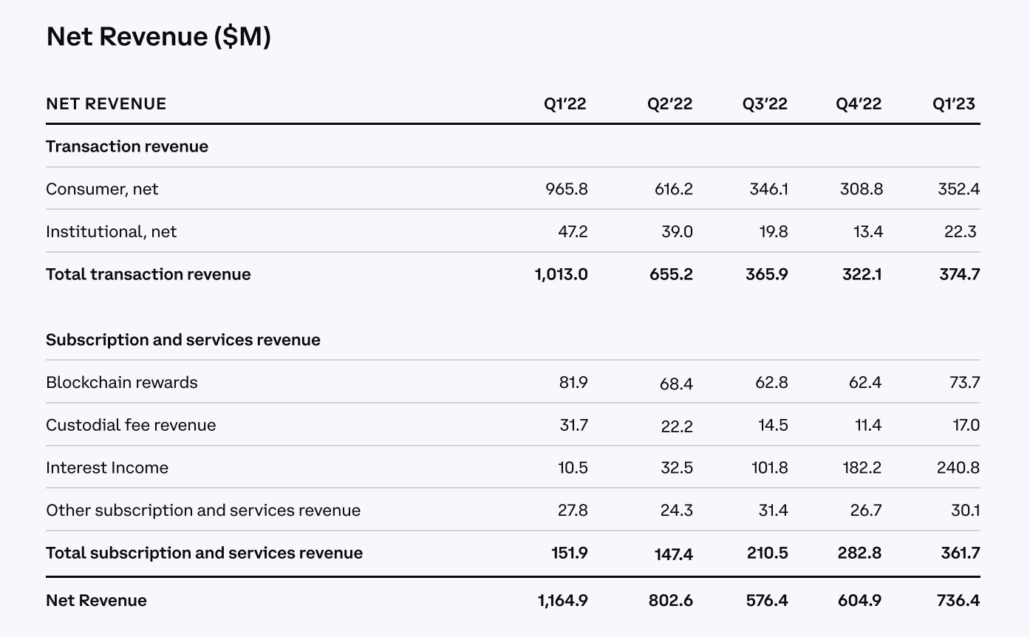

Slimming down seems to have paid off. In the first quarter of 2023, Coinbase’s net revenue grew by 22% and its total operating expenses declined 24%. The exchange reported a quarterly loss of $79 million (its fifth quarterly loss), but this figure is down 86% from the $557 million loss reported in Q4, 2022.

The balance sheets also marked a return to a positive Adjusted EBITDA of $284 million.

What is an Adjusted EBITDA?

Adjusted EBITDA (earnings before interest, taxes, depreciation and amortisation) is a financial measure that shows how much money a company is making from its main operations before certain expenses are taken into account. It’s like looking at a company’s earnings (or profit) without including some of the costs that might not be directly related to running the business. These costs could be things like interest on loans, taxes, or the loss of value over time of assets like equipment or buildings (called depreciation and amortisation).

In Coinbase’s case, a return to a positive Adjusted EBITDA of $284 million indicates that when certain expenses are excluded, the company generated a profit from its operations.

At the end of Q1, Coinbase’s balance sheets remained strong with $5.3 billion in $USD resources.

Coinbase is known for its higher-than-average transaction fees. In Q1, transaction revenue from its institutional base jumped from $13.4 million to $22.3 million – a 66% increase.

Consumer transaction revenue also increased by 14%, jumping from $308.8 million to $352.4 million.

In addition, the Coinbase (COIN) share price jumped by 7% upon publication of the Q1 balance sheets, suggesting investors are optimistic about Q2.

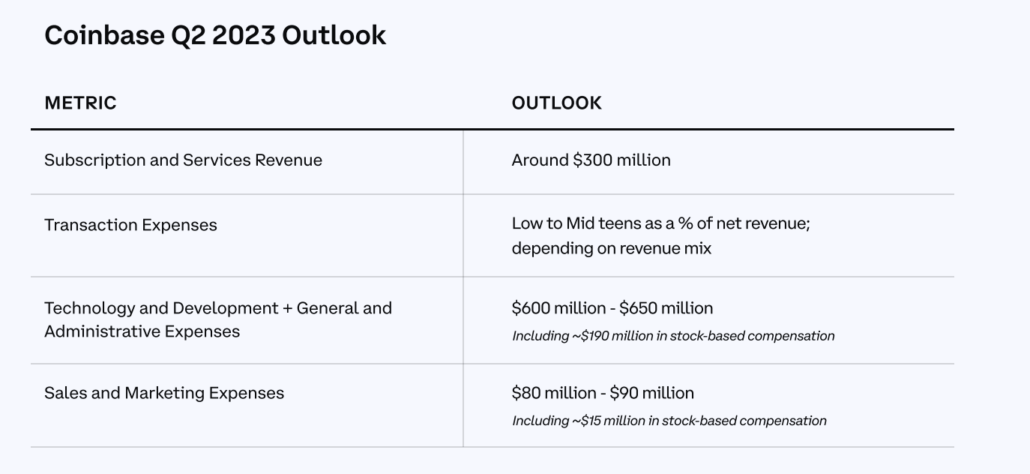

Here’s the outline for Q2 outlined by Coinbase:

Disclaimer: CryptoPlug does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.