Solana has gained 520% this year, outpacing Bitcoin, Ethereum and XRP. Let’s look at what’s driving the surge.

2023 has been a great year for most cryptocurrencies, but for Solana (SOL), it’s been excellent.

Solana is trading at $76.92 at the time of writing, representing a 523% gain from this time last year.

Today, Solana flipped XRP to become the fifth largest cryptocurrency by market cap, holding a capitalisation of $33.38 billion. SOL also surpassed Ethereum’s 24-hour decentralised exchange volume, marking another major milestone.

So, what’s driving SOL’s momentum?

1. Adoption and DeFi

Throughout 2023, the Solana network made leaps with institutional adoption, partnering up with Visa, Shopify and USDC, boosting investor sentiment.

Read more: Solana Pay integrates with Shopify, opening gateway to Web3-based daily commerce

Solana has also dominated the decentralised finance (DeFi) sector this year through various platforms such as Raydium, Serum and Orca.

Orca and Raydium collectively surpassed a trading volume of $3 billion in November, contributing to a substantial rise in Solana’s TVL and enhancing the overall liquidity and activity within Solana’s DeFi ecosystem.

2. Solana memecoins have soared

Bonk, a Solana-native memecoin that launched in December 2022, had an extremely volatile month, gaining up to 905% at some points. The memecoin initially launched as a free airdrop to the Solana community on Christmas Day 2022, but it has already outpaced other major memecoins, such as Pepe, in terms of market capitalisation.

At the time of writing, Bonk holds a market cap of $1.1 billion, whereas Pepe, an ERC-20 memecoin, holds a cap of $535 million.

Bonk has since cooled off a little, but it is still trading at a 300% gain from last month.

Bonk describes itself as the “true community coin” of Web3, with the token’s utility coming from various ecosystem integrations such as NFTs, DeFi, artist support and a DAO.

Related: Dogecoin celebrates 10th birthday and hits $0.10 for the first time all year

3. Firedancer went live on testnet

One of Solana’s biggest pain points is that the network has been plagued by outages which have historically damaged the price.

The network is however implementing a long-term fix for the problem, Solana founder Anatoly Yakovenko said on Decrypt’s gm podcast.

In November, SOL surged 80% as Firedancer, the networks’s new independent validator client, went live on testnet. Firedancer is a long-term scaling solution that minimises the risk of software glitches on Solana, improving the network’s reliability.

4. Solana inscriptions are on the rise

Bitcoin Ordinals (BRC-20 tokens) have taken the non-fungible market by storm this year. Unlike NFTs, Ordinals inscribe data, such as JPEGs, directly onto individual satoshis (the smallest unit of a Bitcoin) to create unique on-chain digital artefacts.

Read more: Bitcoin lender secures $1.25M in pre-seed funding to accelerate Ordinal-backed lending

Solana has now developed its own token standard similar to BRC-20, called SPL-20. SPL-20 improves the interoperability of the Solana ecosystem and simplifies the token development process, broadening the scope for use cases like DeFi protocols and NFTs.

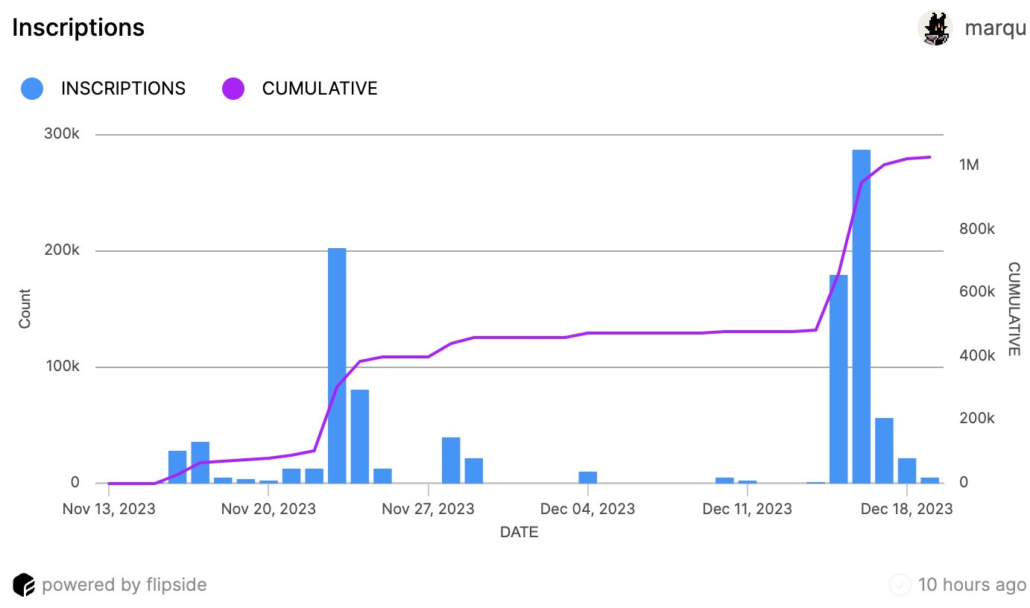

On December 18, the network recorded one million cumulative SPL-20 inscriptions – its first major milestone. This surge welcomed over 15,000 new creators, signalling a jump in demand for on-chain digital artefacts beyond Bitcoin.

Data from CryptoSlam shows that Solana saw a 400% increase in NFT sales volume over the past 30 days, outpacing both Bitcoin and Ethereum.

While Solana has outpaced Ripple (XRP) in terms of price growth and adoption this year, it’s important to note the differences between the two.

The primary use for XRP leans more toward cross-border payments, aiming to streamline and speed up international money transfers. Solana on the other hand is more geared toward decentralised applications, from games to DeFi to NFTs, which naturally attract a wider user base.

XRP also faced a mammoth lawsuit with the SEC this year, though it won a notable victory in July, when the court ruled that Ripple did not violate federal securities law by selling XRP on public exchanges.

At the time of writing, XRP is trading at $0.61, representing a 77% gain from last year.

Disclaimer: CryptoPlug does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.