The USDT-Russian ruble trading volume has surged to its highest level since December 2022.

The short-lived Wagner rebellion in Russia seems to have led to an increase in interest in trading Ruble against the Tether’s stablecoin USDT.

Russians sought refuge in the stablecoin amid the brief military insurrection in the country.

Tether trading volume triggered by Wagner’s unrest

Many Russians found safe haven in crypto during the national unrest triggered by the Wagner mercenaries group.

Last Saturday saw the country almost plunge into a full blown civil war when Yevgeny Prigozhin, leader of the Wagner mercenary group, captured the southern Russian city of Rostov-on-Don and his forces pushed forward northward toward Moscow. This was considered an apparent coup attempt against the Russian President Vladimir Putin.

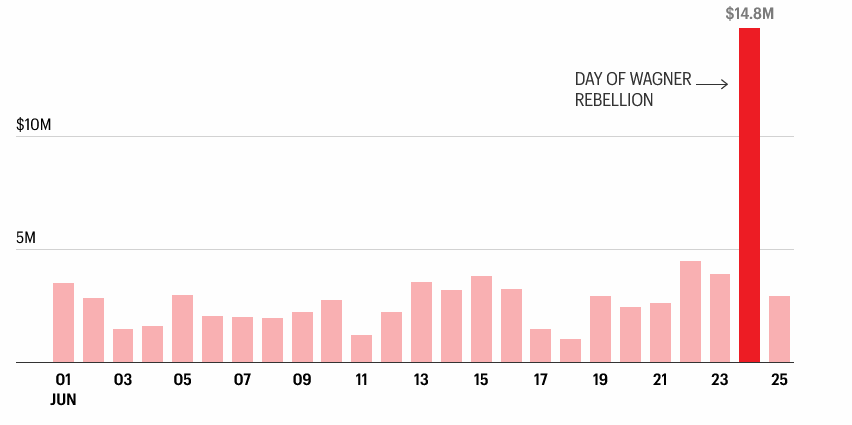

According to latest data from CCData, during the mutiny, trades between the Russian currency, rubles, and Tether’s US-dollar backed stablecoin, USDT skyrocketed from $4M to an almost quadruple of $15M on Sunday. This was a six-month high.

But as the conflict de-escalated through a Belarus-brokered deal, USDT dropped to about $3M.

Read more: Circle CEO predicts Bitcoin ETF approval, but at what cost?

Not the first time

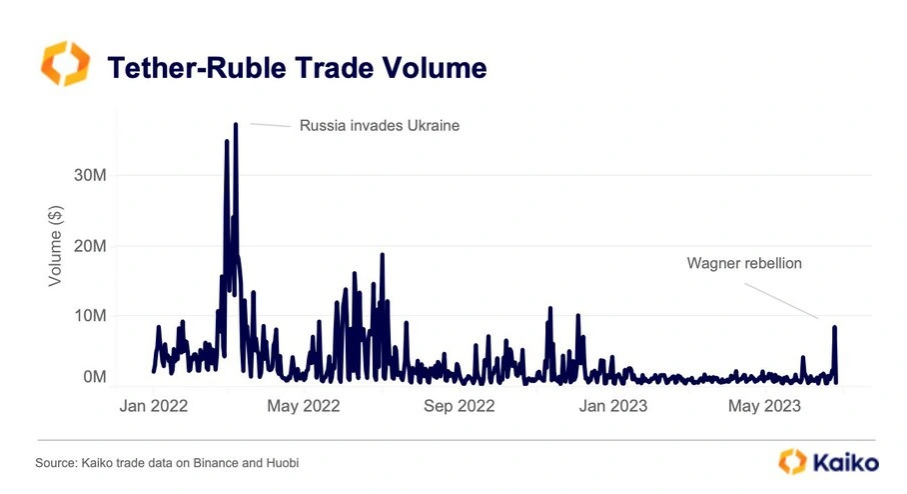

This isn’t the first time that Russians have turned to crypto due to political instability. Following the invasion of Ukraine in late February 2022, the trading volume between the rubles and Tether surged. According to data from Kaiko, the volume peaked at above $37M before exchanges started delisting their rubles trading pairs.

During times of crisis, citizens of countries with political and economic challenges have frequently turned to cryptocurrencies for safety. According to a study published earlier in June by Bloomberg, demand for tether in Turkey, for instance, has been high since May amid record-high currency inflation.

The Argentinian peso and stablecoins like USDT and Circle’s USDC have also experienced a sharp increase in trade volume due to Argentina’s years-long inflation. And people in Venezuela who have been impacted by the ongoing economic crisis continue to demonstrate an interest in stablecoins.

Disclaimer: CryptoPlug does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.