Kasikorn Bank, the second largest in Thailand, aims to capture 20% of the cryptocurrency market share in Thailand by 2024.

Kasikorn (KBANK), the second largest bank in Thailand, has fortified its crypto footing this week, acquiring a majority stake (97%) in the parent company of crypto exchange Satang.

Satang is a regulated digital asset platform that offers crypto trading services in Thai bhat. It was founded in 2017 and has over one million users.

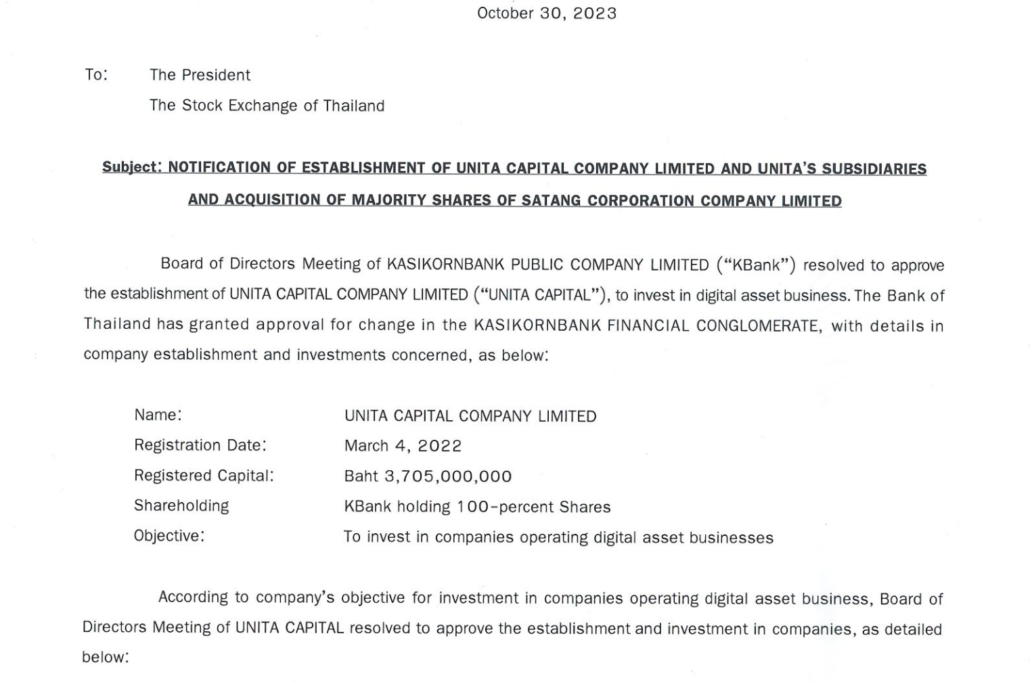

An October 30 letter filed to the Stock Exchange of Thailand reveals the deal is valued at 3.7 billion Thai baht, approximately $102.8 million. The acquisition was done through a new subsidiary called Unita Capital, which will invest in digital asset businesses.

Once the acquisition is complete, Satang will rebrand to Orbix Trade Co. Ltd with three new subsidiaries: Orbix Custodian, Orbix Invest, and Orbix Technology & Innovation, which will focus on blockchain development.

Related: Standard Chartered to launch new crypto custody service in Dubai within months

The acquisition marks a significant step in Thailand’s growing institutional adoption of cryptocurrency. Local news source Siam Blockchain reported that Kasikorn Bank aims to capture 20% of the cryptocurrency market share in Thailand by 2024.

Last month, Kasikorn launched a $100 million fund targeting Web3, AI and global fintech.

Additionally, Thailand’s new Prime Minister, Srettha Thavisin, was an active crypto investor before his election. As part of his campaign, he promised to airdrop 10,000 baht ($300) in digital currency to all Thai residents over the age of 16.

The tokens will be valid for six months and can be spent within four kilometers of a person’s home, local news reported.

Last week however, the Thai government announced that the airdrop has been delayed while it develops an enhanced security system.

Disclaimer: CryptoPlug does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.