The survey suggests that the NFT market is maturing and branching out beyond JPEG artwork.

The NFT market took off in 2021, reaching a market size of USD 15.54 billion in the space of a year. Notwithstanding the 2022 bear market , the NFT industry has changed significantly over the past two years. In 2021, it was commonplace to see crypto whales dropping millions on quirky JPEGs, but today, NFTs have become far more disruptive and radical in their applications.

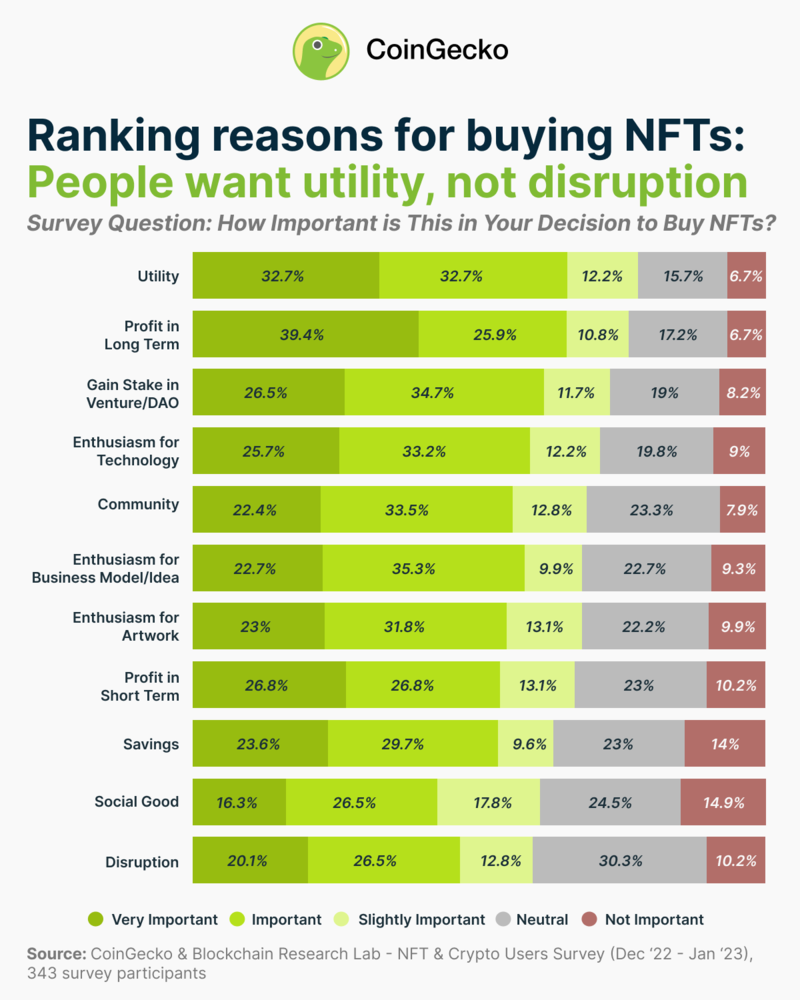

A new CoinGecko survey has found that the main reason people buy NFTs today is not art enthusiasm or short-term profitability, but utility. The study, conducted jointly by CoinGecko and Blockchain Research Lab, examined 343 responses from the NFT and Crypto Users Survey, and here are the findings.

Utility

NFTs with utility have a function outside of the artwork, and sometimes outside of the internet itself. Popular utilities include DAO voting rights, access to real life events or receiving exclusive merchandise. Over the past year, utility NFTs have started to creep into other sectors, such as the luxury and concierge industries.

Drunken Monkey Members’ Club, for instance, gives its NFT holders lifetime access to a global concierge network, offering perks such as hotel discounts, personalised travel itineraries and more.

Other exciting utility projects include Moss Amazon, which enables holders to participate in rainforest preservation, and World of Women, which uses NFTs to give holders exclusive access to real life events and discounts.

The survey found that at least 3 out of every 4 NFT holders consider how much utility a collection offers before buying. This is good news for the crypto industry, as many people believe that utility is the key to long-term mass adoption of NFTs.

In addition, 7 out of every 10 NFT holders said they are motivated by the opportunity to gain a stake in the venture or decentralized autonomous organization (DAO), a key utility for many projects.

Just 6.7% of respondents felt utility is not important at all.

Long-term profitability is a close second.

The second most important reason for buying an NFT after utility was long-term profitability. Not dissimilar to traditional art, many holders buy NFT art with the intention of selling it later on, with 3 in 4 holders stating they intended to sell at a higher price later down the line.

Blue chip NFTs (i.e. those that are expected to hold long-term value) rose to prominence during NFT boom of 2021. Despite the crypto winter of 2022, Bored Ape Yacht Club still holds a floor price of 60.25 ETH (approx USD $112,483) with a total volume of 985,070 ETH (approx USD $1,846,730,430).

Another 17.2% of NFT holders indicated that they are neutral about profiting from NFTs, and a 6.7% minority felt that it is not important to profit from buying NFTs.

Disrupting established structures ranked lowest priority for buyers.

Enthusiasm and community belonging ranked mid-importance, but surprisingly, the least important factor for holders was ‘disrupting established structures or industries’. Web3 in general is a highly disruptive sector that reshapes how we think about ownership, content creation, contracts and more.

While disruption was the lowest priority, 6 in 10 still considered it important, with 3 in 10 remaining neutral.

Disclaimer: CryptoPlug does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.