BlackRock claims the new structure will bring “superior resistance to market manipulation”, boosting the odds of appeasing the SEC.

Over the past six months, the cryptocurrency market has been hinged on the potential approval of several spot Bitcoin ETFs by the United States Securities and Exchange Commission (SEC).

The most widely anticipated application comes from BlackRock – the world’s largest asset manager. BlackRock’s proposed ETF, known as the iShares Bitcoin Trust, will invest directly in Bitcoin, sparking a wave of bullish momentum.

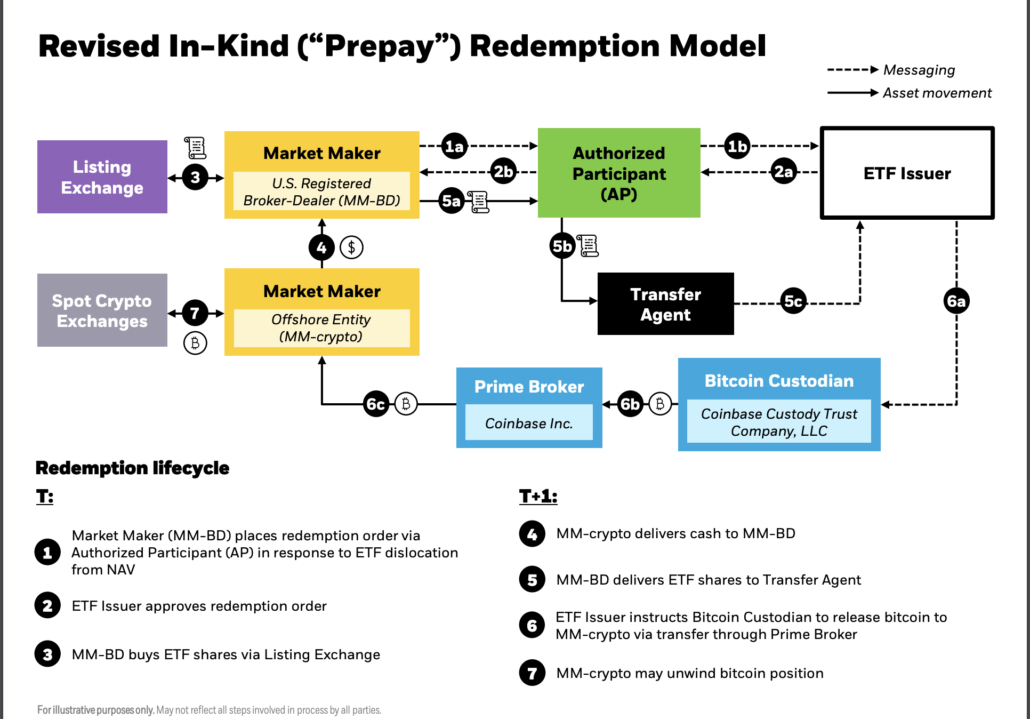

A new SEC memo detailing a meeting between the SEC, BlackRock and Nasdaq shows that BlackRock has modified the mechanics of its Bitcoin ETF to make it easier for Wall Street banks to participate in the fund.

The updated structure enables regulated banks to create new fund shares with cash, rather than only cryptocurrency, primarily because most banks are not permitted to hold Bitcoin.

Under the new proposal, banks can transfer cash to a broker-dealer, and the broker-dealer will then convert the cash into Bitcoin. The Bitcoin is then stored by the custody provider of the ETF, which is Coinbase Custody in BlackRock’s case.

The update presents a huge opportunity for Wall Street banks to get involved in Bitcoin without directly buying it, but institutions such as JPMorgan are yet to express interest.

In fact, last week, JPMorgan CEO Jamie Dimon slammed the wider crypto sector, saying he’d “close it down” if he were the Fed.

Dimon’s comments sparked backlash from the crypto community who were quick to point out that JPMorgan is the second-most fined bank, having paid $39.3 billion in fines across 272 violations since 2000. JPMorgan also has its own crypto on a private version of Ethereum, called JPM Coin.

What are the implications of the update?

The amendment is likely to boost BlackRock’s chances of approval. The filing states that the model provides “superior resistance to market manipulation”, which has until now been a key pain point for the SEC.

Opening the doors to huge banks is also likely to boost liquidity, making the ETF more attractive to a broader range of investors.

There are however downsides: one being that centralised Wall Street banks are in many ways the very opposite to the Bitcoin network envisioned by Satoshi Nakamoto in the seminal Bitcoin white paper.

Banks the size of JPMorgan and Goldman Sachs could in theory exert significant influence over the Bitcoin market, undermining the decentralised nature of cryptocurrencies, where no single entity is supposed to have control or undue influence.

Additionally, the update in BlackRock’s ETF structure shifts risk from banks and places it on crypto market makers instead, potentially exposing them to greater risk while insulting big banks.

In an interview, CF Benchmarks CEO Sui Chung said, “If the SEC accepts this revised, dual model of create and redeem with cash and physical, that means the liquidity that supports the ETF shares when they trade would be increased, because obviously, you have more potential APs as part of the process.”

Chung added, “And although trading firms like Jane Street, etc. are large and are experts, they fundamentally don’t have the trillion-dollar plus balance sheets that large American banks have.”

Since BlackRock’s filing for the Bitcoin ETF on June 15, 2023, the price of Bitcoin has surged by more than 60%, climbing from approximately $25,500 to $41,000.

A final decision on BlackRock’s ETF is expected in January 2024.

Disclaimer: CryptoPlug does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.