BlackRock, the world’s largest asset manager, has officially filed a Form S-1 with the SEC, seeking approval to launch an ETF that invests in Ethereum.

Last week, a NASDAQ filing revealed that BlackRock plans to launch a spot Ethereum ETF, if regulatory approval from the US Securities and Exchange Commission (SEC) is granted.

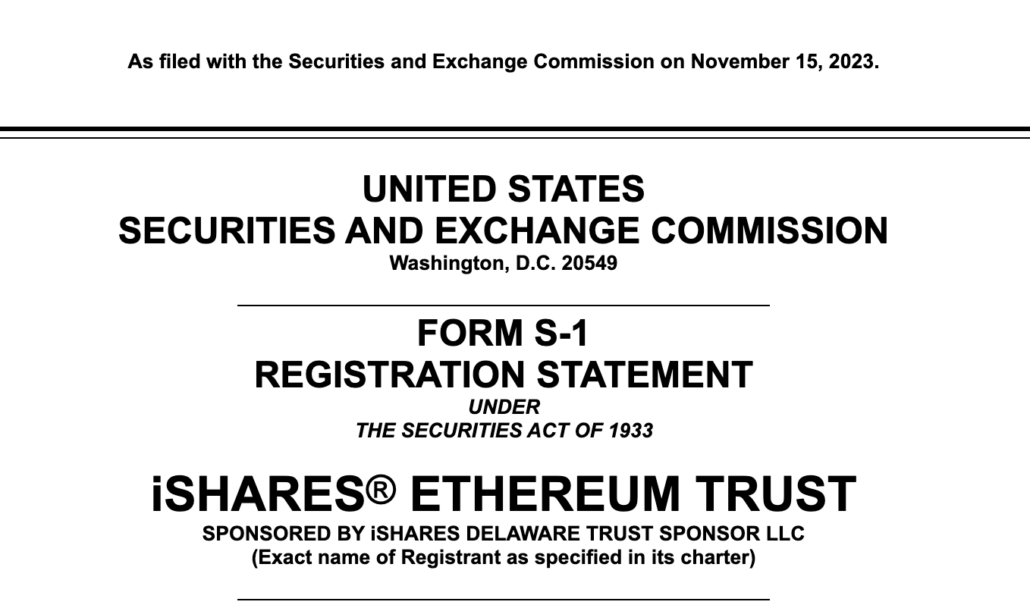

A new November 15 filing shows that BlackRock has now formally filed its S-1 registration statement with the SEC, bringing the asset manager one step closer to launching an ETF that invests directly in Ethereum.

Similar to its proposed spot Bitcoin ETF, the Ethereum ETF is called the iShares Ethereum Trust. The ETF aims to launch on NASDAQ, but the ticker is yet to be revealed.

Coinbase is set to be the custodian of the Ethereum, but an unknown third party will hold the cash. BlackRock will share a surveillance sharing agreement (SSA) with Coinbase, which is thought to boost the odds of approval.

Read more: ARK Invest modifies Bitcoin ETF application to include surveillance agreement

The Form S-1 reveals that the Ethereum ETF will track the price of Ether, reflecting its performance before fees and expenses.

The Net Asset Value (NAV) will be calculated daily using the CME CF Ether-Dollar Reference Rate index.

The projected date of launch is yet to be specified.

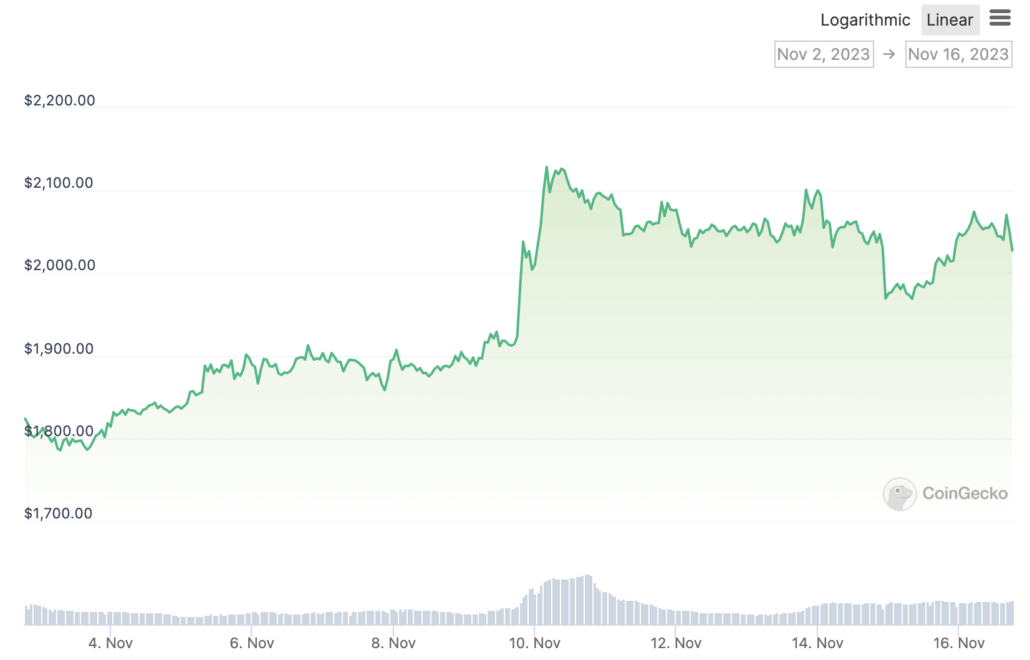

Ether has responded bullishly to the filing

Since Nasdaq confirmed BlackRock’s plans for an Ethereum ETF last week, Ether has gained around 7%.

It is trading at $2,043 at the time of writing, and has gained around 2% today, per CoinGecko data.

Ethereum Futures ETFs are already trading on the market, but a spot ETF marks a huge step forward in terms of institutional adoption. Futures ETFs bet on the future price of Ether, while a spot ETF will directly invest in the crypto.

Read more: Approved: Valkyrie to add Ether futures to existing Bitcoin futures ETF

There are now a total of 12 spot Bitcoin-related ETF filings, four spot Ethereum ETF filings, and seven Ether futures-related ETFs on the SEC’s docket.

Disclaimer: CryptoPlug does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.