Friend.tech saw over $10M in trading volume over the weekend, but a surge in withdrawals and lack of user growth may warrant caution.

Friend.tech, the buzzy SocialFi platform that’s attracted both favour and controversy over the past few months, has witnessed a surge in trading volume over the weekend, accumulating more than $10 million.

While this may seem like positive news, industry analysts are cautioning against optimism, warning that the spike could be indicative of exit behaviour.

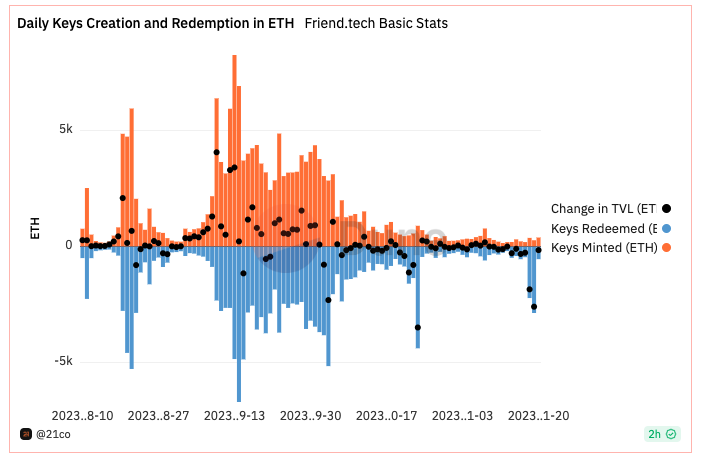

Exit behaviour is typically characterised by a rapid withdrawal of assets from a platform. Dune Analytics data reveals that over 5,000 ETH was pulled out of the platform during the weekend, marking the largest withdrawal surge in a month.

Read more: OnlyFans creators flock to friend.tech following new image sharing update

Data also shows the rate at which keys are being redeemed is outpacing their minting, raising concerns about Friend.tech’s stability.

TVL has seen a sharp decline

Another key metric is total value locked (TVL), which represents the total value of assets locked in a particular protocol.

Friend.tech’s TVL experienced a sharp decline of 21% over the weekend and is now approximately $33.9 million, per Dune data. This marks the lowest TVL for the SocialFi platform since September.

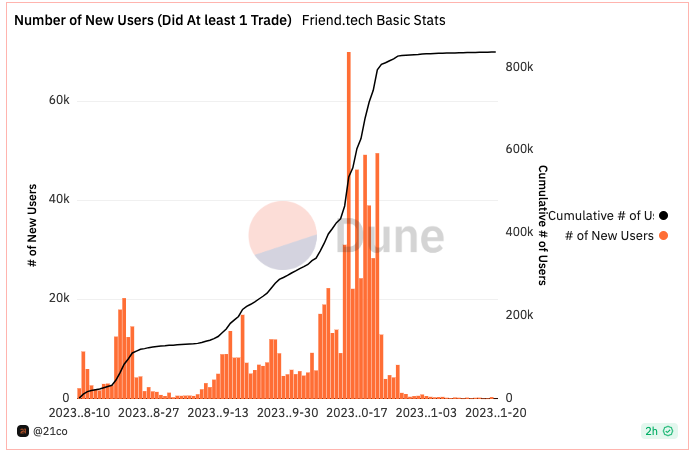

In addition to the falling TVL, analysts have raised concerns about the increase in trading volume despite no real user base growth.

The number of new users has effectively plateaued since late October.

This stagnation is likely influenced by the platform’s battle against scams and bots.

Over the weekend, Friend.tech’s team reported the identification and removal of 600,000 accounts flagged as bots.

Disclaimer: CryptoPlug does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.