Sonnenshein has expressed concern about the next steps that Grayscale has to take.

Grayscale Investments CEO Michael Sonnenshein has shown concern over the next steps the firm will have to make following their win against the US Securities and Exchange Commission (SEC) on Tuesday.

The firm’s chief is unsure whether Grayscale will have to refile or not.

Grayscale may have to wait

In a recent interview with “Bloomberg Markets,” Grayscale Investments CEO Michael Sonnenshein described the firm’s win at the District of Columbia Court of Appeals in Washington as an “overwhelming victory” that may change the environment around crypto.

A three-judge panel declared that the SEC refusal of the application from the firm to convert its Grayscale Bitcoin Trust (GBTC) into a spot Bitcoin ETF was “arbitrary and capricious”

However, Sonnenshein has expressed concern about the next steps that Grayscale has to take. He said that the firm will have to wait till the final procedures are laid out within the next 45 days by an en banc hearing. The hearing will involve all 17 judges on the court, as opposed to the initial subset panel of three judges.

“We will have to see upon the final operational procedures that come through that final mandate that the court will issue.” He further added, “We don’t know what the final opinion will say until we reach the end of that period.”

Sonnenshein also warned that the way forward isn’t yet clear but optimism should send a message to the SEC to stop rejecting innovative products from coming to the market.

“There really shouldn’t be any further grounds like the SEC has been relying on to continue denying these types of products from coming to market,” he said.

On whether the ETF application itself will be granted, the CEO said that he’s yet to receive any information from the SEC post court victory. The SEC also has until mid-October to request a re-hearing of the case.

“We have to be a little bit patient,” Grayscale’s Sonnenshein said.

Read more: SEC decision on 7 key Bitcoin ETFs expected in the next few days

Market downturn

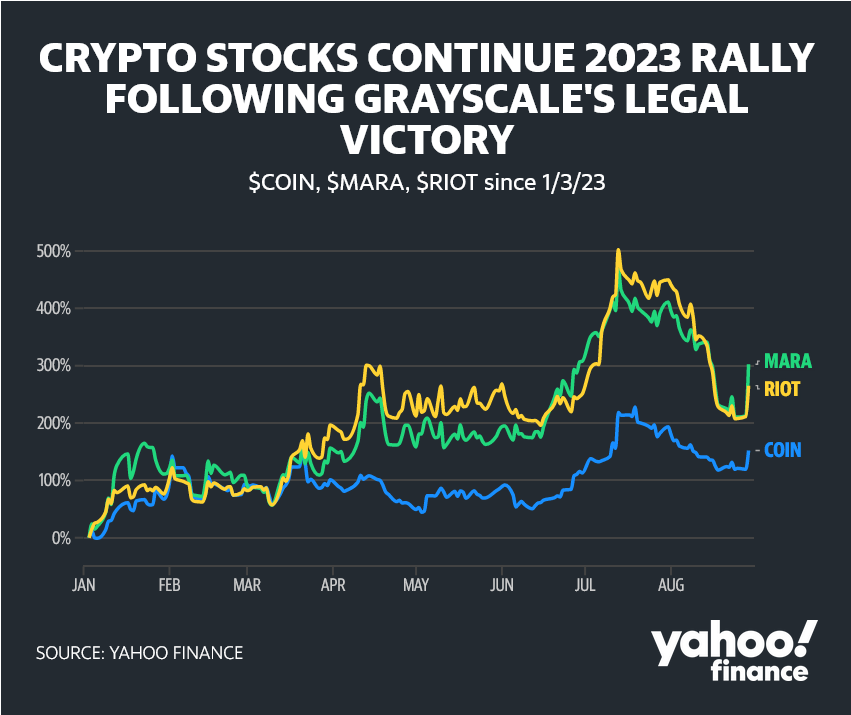

The show of restraint about the future by Sonnenshein may explain why the market rally experienced on Tuesday quickly slowed down on Wednesday. Crypto prices and related stocks lost value in quick succession within a 24 hours time frame.

By late Tuesday afternoon, Bitcoin had momentarily reached $28,000, but by Wednesday, it had fallen to about $27,000.

Wednesday saw a 1.2% drop in the price of Coinbase’s stock, while losses for Marathon Digital (MARA) and Riot Blockchain (RIOT), two companies that mine bitcoin, were 3% and 2.4%, respectively. On Tuesday, all three increased by double digit percentages.

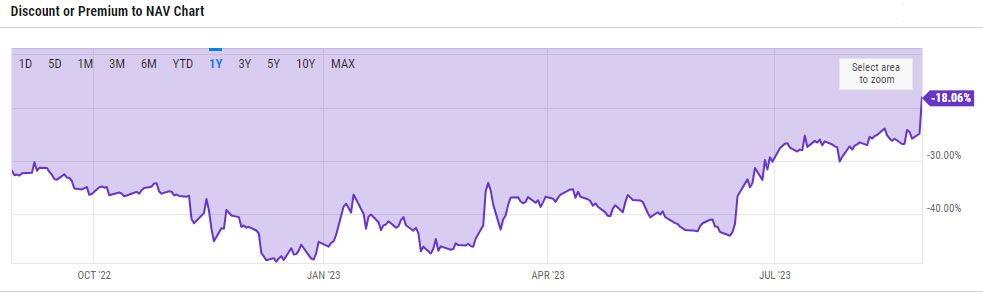

According to YCharts, the Grayscale bitcoin trust (GBTC), the biggest trust holder of bitcoin globally, was down more than 4% on Wednesday and traded at an 18% discount.

The discount would be immediately eliminated if the trust was permitted to become an ETF.

Bloomberg Intelligence ETF analyst James Seyffart said the discount is unlikely to go to zero until the official conversion.

“The discount shows that the market is more confident in conversion today than they were a few days ago, but still not completely confident that GBTC will convert,”Seyffart noted.

Disclaimer: CryptoPlug does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.