The odds of approval have now increased to 95%. Here’s what to expect this week in Bitcoin ETFs.

The Bitcoin market has been steadily heating up since June 15, when BlackRock, the world’s largest asset manager, filed an application with the US Securities and Exchange Commission (SEC) to launch a spot Bitcoin exchange-traded fund (ETF).

Until now, the SEC has rejected all spot Bitcoin ETF applications due to fears of market manipulation and lack of regulatory oversight, but analysts are now 95% confident that multiple ETFs will receive approval by January 10.

Over the past few days, Bitcoin has traded fairly flat at $43,885, as investors anticipate approval. Here are three key events to watch out for this week.

Read more: Matrixport: SEC likely to reject all spot Bitcoin ETFs in January, driving -20% price correction

Approval dates

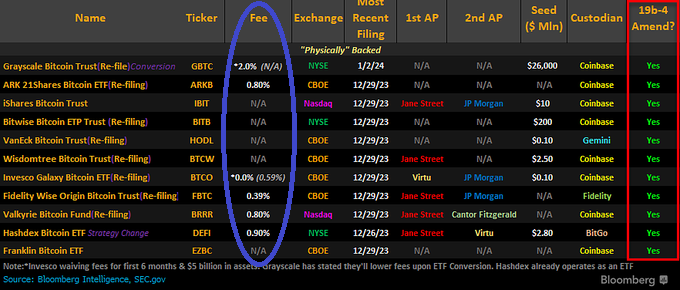

On January 5, 11 asset managers including BlackRock, Fidelity and Grayscale filed 19b-4 amendment forms, signaling a crucial step towards potential launch.

These amendments represent the final adjustments in response to feedback from the SEC, fine-tuning details to align with regulatory requirements and address any concerns raised by the Commission.

Two sources told Bloomberg that the SEC had “no additional feedback” on the paperwork after the latest amendments for some of the firms, which many have taken as a positive sign.

Today, January 8, marks the final day for firms to finalise their S-1 forms (registration statements), according to Bloomberg ETF analyst Eric Balchunas. “Latest I’m hearing (from multiple sources) that final S-1s are due 8am on Monday as SEC is trying to line everyone up for Jan 11th launch. That said, I still want to hear it from the SEC to call it official.”

Fees

As observed by ETF Store President Nate Geraci, issuer fees will be worth keeping an eye on this week. Fees refer to the management fees charged by the ETF providers, and they can impact investor returns.

Since all of the spot Bitcoin ETFs will hold the same asset (Bitcoin), fee levels will be one of the key differentiating factors between the offerings.

“Can’t overstate importance of fees in this competition,” Geraci wrote.

The highest fee thus far is Grayscale, at 2%, but the firm has stated it will lower their fees upon ETF Conversion, according to a Bloomberg document.

Since filing their S-1 in the last hour, BlackRock’s fee has been revealed to be 0.20% for the first 6 months, or until $5 billion in assets is reached, after which it will be raised to 0.30%.

Ark and 21Shares on the other hand have set their fee at 0.25%, with no fee for the first six months, or until $1 billion in assets is reached.

“Told y’all the fee war would break out bf they even launched,” Balchunas wrote on X.

Inflows

The launch of a Bitcoin ETF will likely lead to a surge in institutional investment, since investors will have a means to access the crypto without direct exposure.

If Bitcoin ETFs are approved this month, the market could see inflows of $1 billion in the first few days and $2.4 billion within the first three months, according to VanEck analyst, Patrick Bush.

A notable Bitcoin price increase will likely occur, based on the price trajectory of +80% since BlackRock first filed in June. Several analysts have speculated that this effect might be similar to what was observed with the first spot gold ETF in the US in 2004.

Not all are betting on approval this month, though.

Markus Thielen, Head of Research at Matrixport, caused a media storm on January 3 after publishing a research note stating that all applications still fall short of a “critical requirement” that must be met before obtaining approval.

“This might be fulfilled by Q2 2024,” he wrote, “but we expect the SEC to reject all proposals in January.”

Thielen pointed toward the Democrat-dominated SEC, namely toward Chairman Gary Gensler, who has regularly called for more stringent regulation of the cryptocurrency industry.

Rejection could see a -20% price correction

Following Thielen’s publication, Bitcoin flash-crashed by 7% as hopes of approval appeared to dwindle.

In the event of a rejection, Matrixport projects the price of Bitcoin to drop by 20%.

Since September, $14 billion of extra fiat and leverage has been deployed into the wider crypto market. While some of these flows may be linked to improved macroeconomic conditions, $10 billion is estimated to be linked to optimism of the SEC clearing the first Bitcoin ETFs.

“If there is any denial by the SEC, we could see cascading liquidations as we expect most of the $5.1 billion in additional perpetual long Bitcoin futures to be unwound,” Thielen wrote.

“We could see Bitcoin prices declining by -20% very quickly and falling back to the $36,000/$38,000 range.”

Read more: BlackRock amends ETF structure to make it easier for Wall Street banks to participate in fund

While many investors are bullish on approval, a survey conducted by Bitwise reveals that just 39% of financial advisers in the US forecast approval this year.

Disclaimer: CryptoPlug does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.