Bitcoin mining hashrate enjoys steady rise

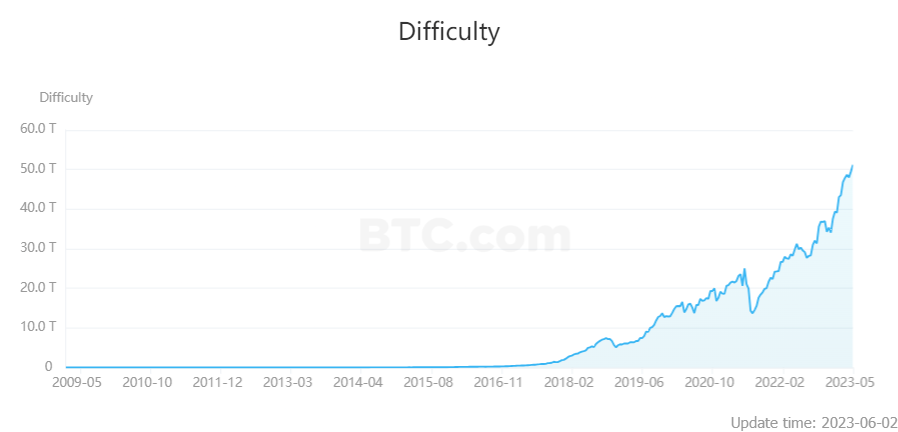

Last month, Bitcoin mining difficulty rose to 3.4%, an all-time high. The network’s hashrate also hit a record high in May indicating that the network got more secure.

Despite network activity remaining strong, Bitcoin lost 8% on macro uncertainty in May.

May favours Bitcoin hashrate

In May, the daily network hashrate rose to a record high. It was the fifth consecutive month of steady rise for the indicator. The “mining hashrate” here refers to a measure of the total amount of computing power that the Bitcoin miners have currently connected to the network.

To understand, the larger the hashrate, the more secure the network is. The declining energy costs, newer and better mining machines, and a steady jump in price have contributed to the rise in hashrate.

According to a June 1 report from BTC.com, the hashrate reached a new ATH on May 31.At the end of May, this number was 51,234,338,863,442, or roughly 51.23 trillion, with an average daily hashrate of 422.24 EH/s. BTC.com predicts that the following projected difficulty will be 51.29 trillion, representing a rise of 0.10%.

Although the steady uptrend saw a sharp decline in May 2021 after China banned PoW mining, a recovery from June 2021 has maintained a notable acceleration in upward trend.

Industry experts have offered their views on why the hashrate has continued to improve. The CEO of mining company BigBlock DC Bitcoin, Seb Gouspillou, attributed it to a flurry of miners updating out-of-date hardware. Sam Wouters, a River Financial analyst, however, ascribed the increase in hashrate to BTC’s strong price movement, which saw the top cryptocurrency rise from $22,000 to $28,300.

Reginald Smith, a JPMorgan analyst said in a note: “Our sense is that network hashrate growth could slow over the coming months (possibly lagging BTC price appreciation) as funding available rack space is hard to come by.”

Read more: Ethereum gas fees drop after May ‘memecoin mania’

Bitcoin price struggles

Bitcoin has continued to navigate macro uncertainties over the last few months. However, the strength of the network remains intact.

The price of the pioneer cryptocurrency saw a positive increase at the start of the last week of May to a three-week high of $28,500. But soon tumbled to a weekly low of $26,500 by Friday.

Consequently, Bitcoin’s market cap has declined by over $5B in a day to $520B. Bringing it dominance over altcoins down to 45.8%.

Last week, JPMorgan said Bitcoin should be trading at $45,000.

Disclaimer: CryptoPlug does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.