US regulators have reiterated that they view “most” cryptocurrencies as securities, but is it a fair classification?

Let’s start with this: if I call my dog a cat, she will not start meowing. Similarly, if I call my cryptocurrency a security, it won’t start issuing dividends. So, why does the SEC insist on calling cryptocurrencies – a wildly unique and innovative new asset class – something they are not?

Yesterday, the SEC sued Binance on 13 charges including misleading investors, mishandling customer funds, and “a blatant disregard” of securities law. The Commission now views 61 cryptocurrencies and mirrored assets as ‘securities’, and has said that crypto providers must comply with existing securities law.

In other economic areas, lawmakers have taken a more progressive approach. Rather than squeezing crypto assets into a legal framework first designed ninety years ago (i.e. the Securities Act of 1933), lawmakers drafted a new framework: MiCA.

MiCA (markets in crypto-assets) is an EU regulation that provides a robust legal framework for cryptocurrencies, stablecoins and other types of digital asset to operate safely. It seeks to protect investors, protect businesses, and facilitate the economic growth of all 27 EU countries.

Recent developments in European Parliament have asserted that crypto assets should be deemed securities by default – but national regulators have authority to say otherwise.

Read more: What’s in the new EU crypto legislation?

Squeezing a new technology into an existing and increasingly outdated regulatory framework is undoubtedly a missed opportunity for US lawmakers.

As Coinbase CEO Brian Armstong said, blockchain technology is not only a financial service – it’s a “transformative technology that can revolutionize a wide array of sectors, of which financial services is just one example”.

Besides, securities law isn’t exactly ‘bad’ – it’s a solid legal framework that’s designed to protect those who invest in stocks, bonds and other securities. The issue is, cryptocurrencies are very different to securities.

So what’s the difference?

A security is a financial instrument that represents a certain value or ownership in an entity, such as a company. They’re used to raise capital or facilitate investments. Common types of securities include stocks, bonds, and derivatives.

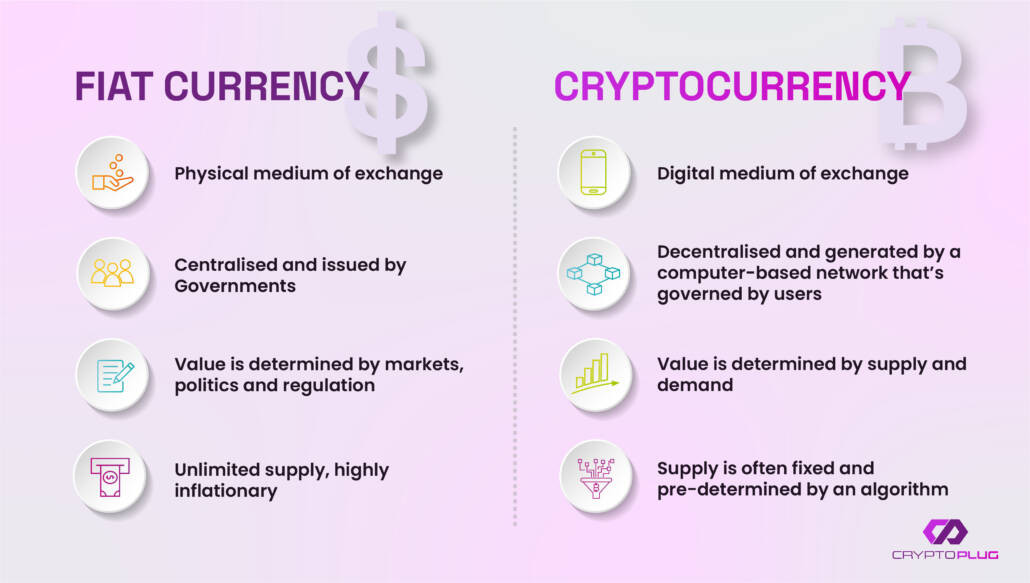

Securities transactions typically involve intermediaries, such as brokers, exchanges, and custodians, who facilitate the buying, selling, and safekeeping of said assets. Cryptocurrencies on the other hand operate via decentralised networks, eliminating the need for intermediaries.

In addition, many cryptocurrencies, namely Bitcoin, were designed to be borderless mediums of peer-peer exchange, rather than investment vehicles.

There are three key reasons why labelling cryptocurrencies as securities isn’t helpful – let’s outline them in turn.

1. The entire point of cryptocurrency is to enable decentralised peer-peer transactions.

Securities and crypto assets operate very differently and serve different purposes. Securities are typically issued by centralised governments or companies, and they represent ownership, debt, or derivative contracts. Cryptocurrencies, in contrast, were initially designed as a medium of exchange which aims to provide a decentralised and secure method of transferring value from one person to another without a middleman.

While digital assets have evolved to encompass various use cases beyond simple transactions (NFTs, DeFi and so on), the original intent, i.e. borderless, peer-peer transactions, remains. Labelling cryptocurrencies as securities threatens to compromise the very principles that Bitcoin, the first and most valuable cryptocurrency, was first designed to uphold.

In addition to this, traditional securities regulations often impose restrictions on who can invest in securities, such as accredited investor requirements. The possibility of excluding smaller investors from the market is fundamentally against the democratic nature of decentralised assets.

2. It’s confusing and may warp investor perception.

Nobody denies that crypto markets are extremely volatile and speculative. It’s a nascent industry, and a lack of reasonable regulation isn’t doing much to help. By viewing cryptocurrencies as securities, the SEC runs the risk of confusing investors and potentially eroding their trust. Many investors perceive traditional securities to be less risky than crypto assets, which is often true. If cryptocurrencies are labelled as securities, investors are far more likely to enter the market with the expectation that it’s safer than it actually is, particularly in terms of volatility.

Investors aside, what about actual issuers and regulators? Stablecoins are very different from memecoins, and NFTs are very different from Bitcoin. Every category of digital asset presents its own risks and challenges, and each must be assessed on a case-by-case basis (as MiCA addresses). This is difficult, if not impossible, to do without a new legal framework.

3. It strangles innovation.

It’s true that blockchain technology can be used for much more than financial services, but the financial sector itself is in need of innovation. When the SEC first published its stance on the crypto/securities conundrum, Commissioner Hester Peirce published a scathing dissent, writing “stagnation, centralization, expatriation, and extinction are the watchwords of this release”.

She continued, “Rather than embracing the promise of new technology as we have done in the past, here we propose to embrace stagnation, force centralization, urge expatriation, and welcome extinction of new technology.”

Digital assets and the smart contracts that underpin many of them have the power to transform a range of industries, from real estate to insurance to supply chain management. Decentralised assets and apps can also promote financial inclusion in remote, under-funded areas.

Evidently, innovation doesn’t just benefit crypto investors, it has the power to transform our social fabric and financial infrastructure entirely.

Disclaimer: CryptoPlug does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.