OpenSea takes the back seat as Bitcoin Ordinals drive trading volume surges on OKX, Magic Eden and UniSat.

OKX NFT Marketplace recorded a staggering 7-day trading volume of $325 million on December 18, data from DappRadar shows. This surge positions OKX as the largest NFT marketplace by daily trading volume, outpacing Blur, Magic Eden, UniSat and OpenSea.

Data shows that the marketplace facilitated almost 130,000 sales over the past week, across 11 different blockchains.

Bitcoin Ordinals are driving marketplace volume surges

NFT marketplaces that support Bitcoin Ordinals, such as OKX, Magic Eden and UniSat, all saw notable increases in volume over the past 7 days. Blur and OpenSea, which have not yet capitalised on Ordinals, experienced a sharp decline.

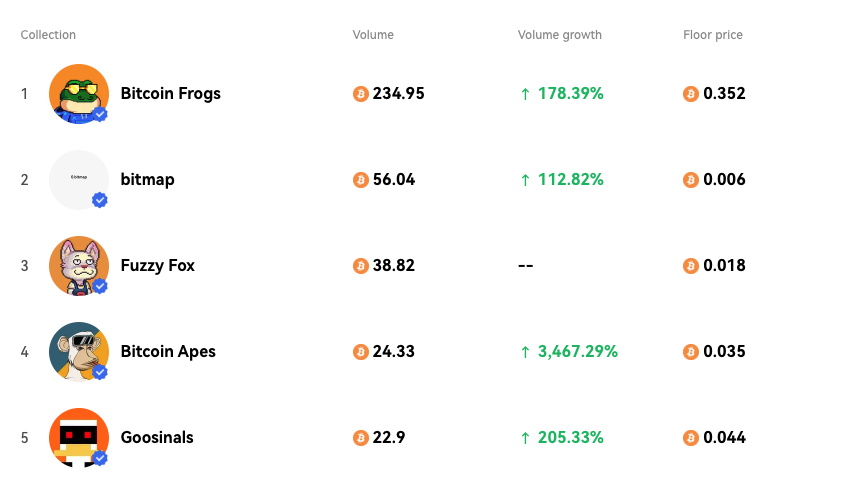

On OKX, Bitcoin Frogs saw a weekly volume growth of 178%, holding a floor price of 0.352 BTC ($14,000). Bitcoin Apes, a collection of “byte-perfect inscriptions” of Ethereum ape images onto the Bitcoin blockchain, saw a particularly huge surge in volume growth, recording gains of 3467%.

Although Bitcoin Apes resemble the original Bored Ape collection, the collection is not affiliated with Yuga Labs.

Legacy blue-chip NFT collections on Ethereum still capture a large portion of trading volume on OKX, with Bored Ape Yacht Club and Pudgy Penguins recording a weekly trading volume of $15 million and $14 million respectively.

The NFT marketplace landscape is changing

Early adopters of NFTs will remember the days when OpenSea dominated the market by a large margin. While OpenSea remains the largest in terms of users, its dominance was disrupted in October 2022 by the launch of Blur.

Blur famously targeted OpenSea by reducing trading fees to zero and cutting royalty fees. OpenSea initially responded by enforcing a block on all collections listed on non-royalty fee-paying platforms, but Blur managed to find a way around this block, further intensifying the competition. This eventually led to OpenSea to stop enforcing creator royalties, which caused industry-wide upset among NFT creators.

Read more: OpenSea breaks creator fee structure, makes royalties optional

Blur aside, Bitcoin Ordinals have caused further disruption to the legacy NFT market, driving up volume and activity on newer or smaller exchanges like OKX and Magic Eden.

Unlike NFTs, Bitcoin Ordinals inscribe data directly onto individual satoshis (the smallest unit of a Bitcoin). While some are critical of Ordinals, arguing that they unnecessarily inflate Bitcoin transaction fees, they have changed the way we think about NFTs and the potential utility of the Bitcoin blockchain.

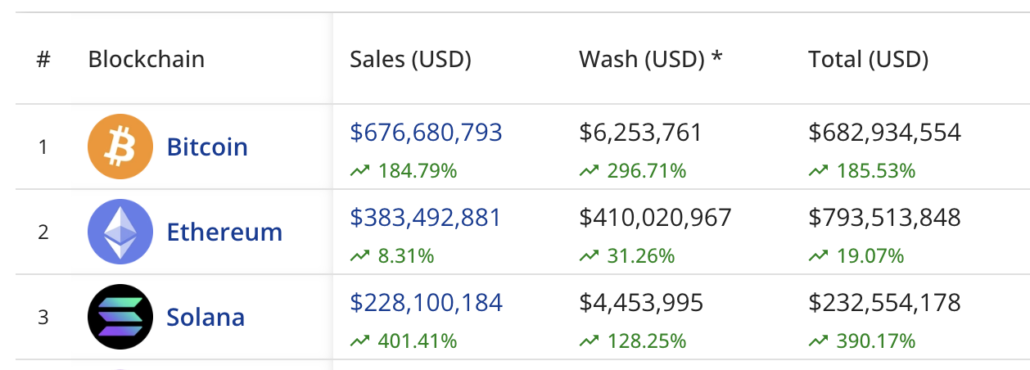

Data from CryptoSlam shows that Bitcoin has experienced a 185% increase in Ordinal-driven sales over the past 30 days. Of this, $SATS and $RATS Ordinals brought in the highest sales volumes, generating $93 million and $61 million respectively.

Ethereum NFTs on the other hand saw a rise of 19%.

Disclaimer: CryptoPlug does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.