dappGambl revealed that it analysed 73,257 NFT collections and identified some key trends common to most collections.

A new study on the NFT market has noted that the once booming market has crashed, leaving most tokens worthless.

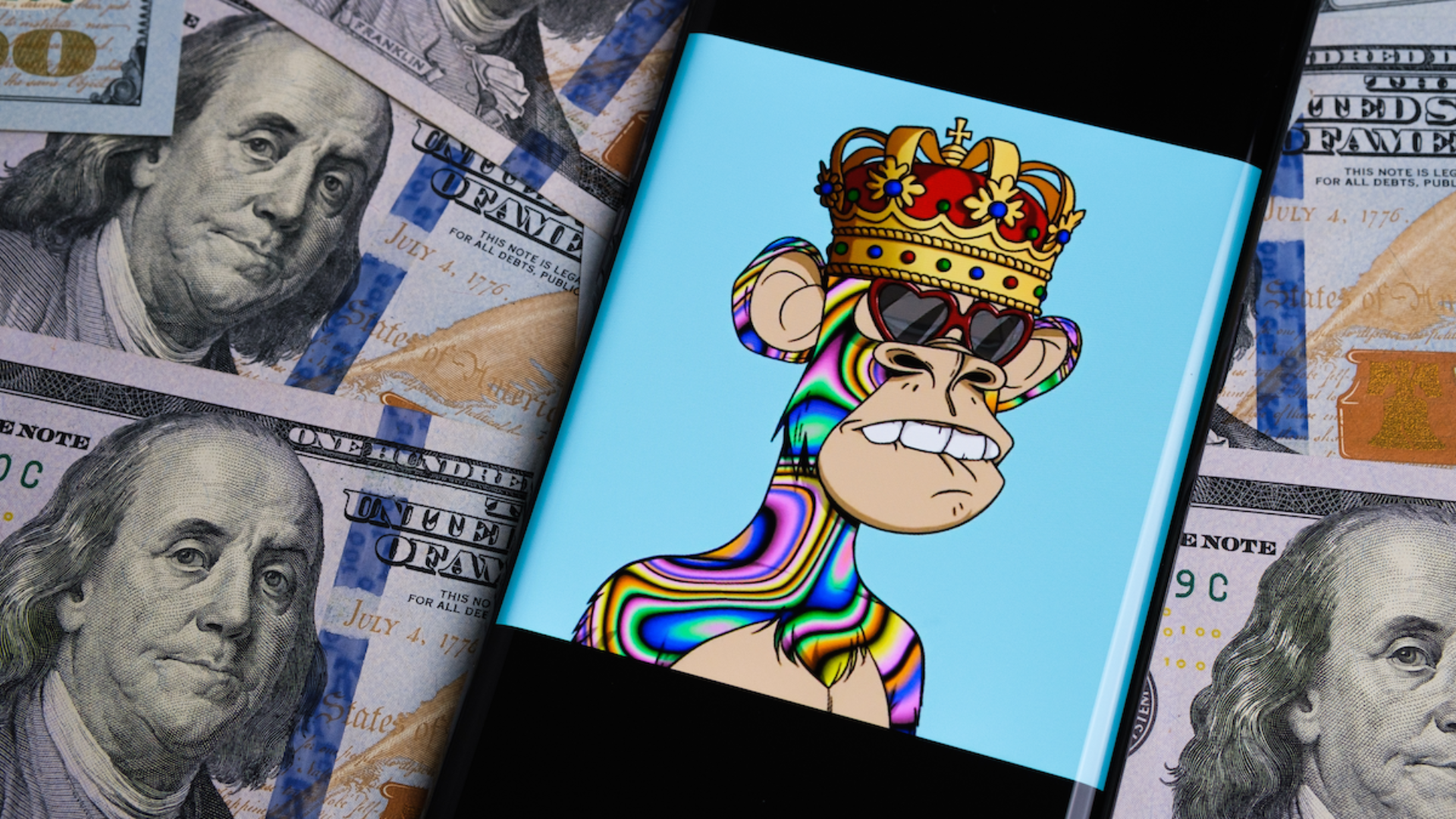

NFT bubble may be burst now

Web3 review and betting website dappGambi released new study on the state of the NFT market. The site which uses data from aggregating sites like Coinmarketcap and NFT scan noted that more than 95% of NFT collections have lost almost all their values.

The study, titled “Dead NFTs: The Evolving Landscape of the NFT Market,” revealed that it analysed 73,257 NFT collections and identified some key trends common to most collections. The study concluded that a staggering 69,795 of the collections studied had a market cap of zero ethereum. By estimates, about 23 million people hold these worthless digital assets.

“This daunting reality should serve as a sobering check on the euphoria that has often surrounded the NFT space,” the researchers said. “Amid stories of digital art pieces selling for millions and overnight success stories, it is easy to overlook the fact that the market is fraught with pitfalls and potential losses.”

The once booming NFT market has seen a crash in volumes and nominal value. Most NFTs are trading at a discount rather than premium. The market that once saw celebrities like Stephen Curry, Eminem, Snoop Dogg, etc. Excited is grasping at straws.

The study shows that 79% of the NFTs polled remain unsold, creating an ecosystem where sellers are more than potential buyers.

“Only 21% were fully spoken-for, in terms of having 100%+ ownership. This means that 79% of all NFT collections – otherwise known as almost 4 out of every 5 – have remained unsold,” the study said.

In addition, more than 1,600 of the top listed NFTs are dead, with 18% being at net Zero. $5 to $100 was the price point for most of the most common NFTs.

Read more: Bored Ape Yacht Club NFTs declines as general market continue to bleed

Use cases and disconnect

At their peak, NFTs enjoyed glorious media hype with many spending thousands and millions of dollars on worthless jpegs. The report noted the possibility that many NFT digital assets do not have real life use cases.

dappGambl said: “It becomes clear that a significant portion of the NFT market is characterised by speculative and hopeful pricing strategies that are far removed from the actual trading history of these assets. The key question arises: How many of these NFTs lacked a genuine use case and are now redundant? Without utility, they may be considered ‘dead’.”

Use cases for NFTs include ticket sales, identity and credentials management and verification, real estate sales and ownership, fashion, gaming, and concierge. All of these are developing sectors of the NFT ecosystem that surpasses the scope of jpegs and PFP images.

While companies like Meta have begun winding down their NFT operations, companies like Drunken Monkey Members Club are not backing down. Real life use cases like using NFTs to access a concierge network, which DMMC offers, can prove to be one of the saving grace for the nascent market.

Disclaimer: CryptoPlug does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.