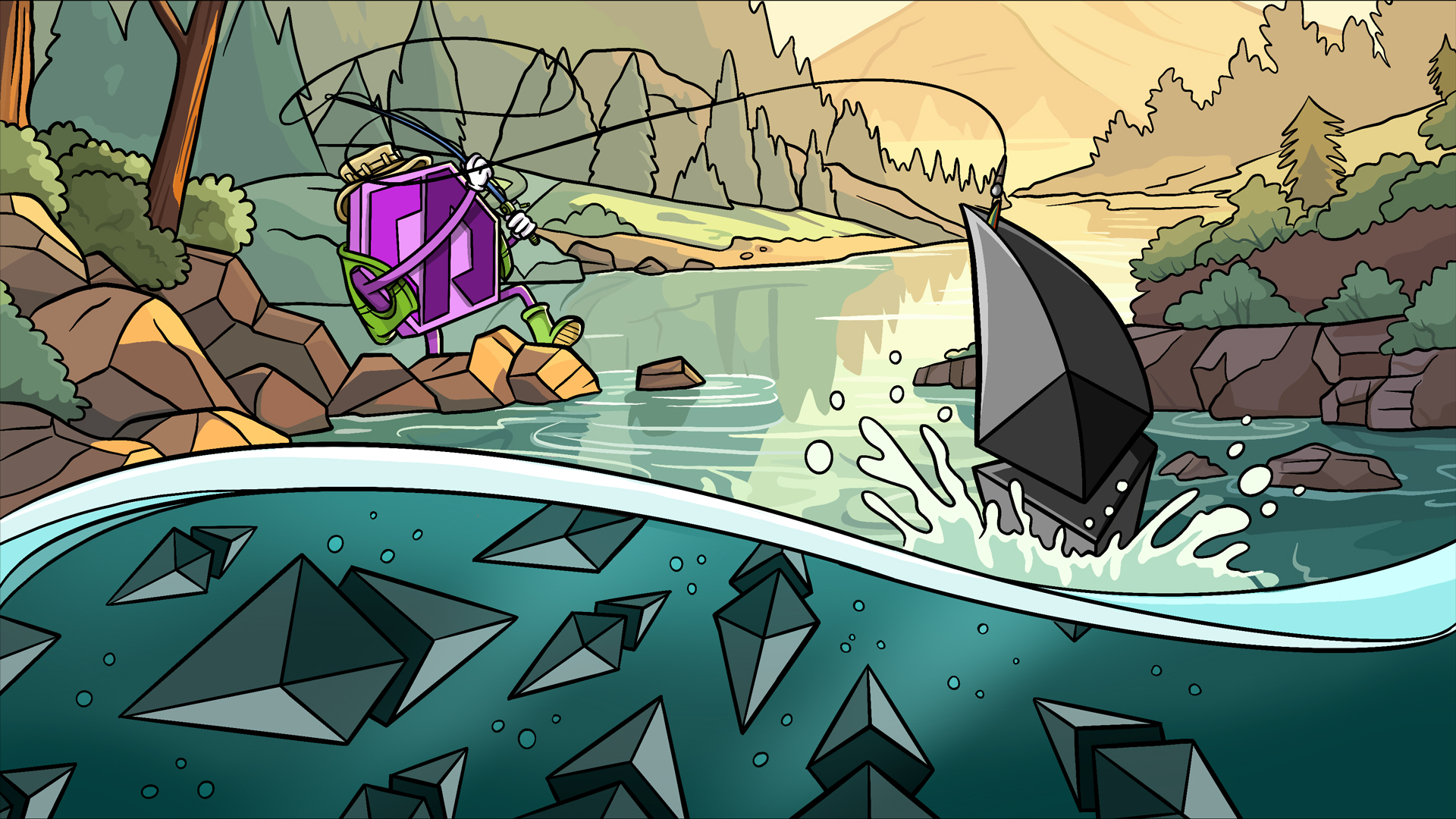

Liquid staking derivatives enable users to stake their cryptocurrencies, such as Ether, while retaining liquidity. Let’s take a closer look.

Since Ethereum’s Shapella upgrade, liquid staking has grown to dominate the world of DeFi. Liquid staking protocols like Lido have already amassed over $14 billion in TVL, and experts predict the sector to double over the next two years, potentially growing into a $1 trillion industry.

Before we understand liquid staking, we must first understand what staking is.

Put simply, staking involves locking up your cryptocurrency in exchange for a reward (i.e. more crypto). It’s a mechanism of proof-of-stake blockchains, such as Ethereum, Cardano and Algorand, and its purpose is to operate and maintain the security of the blockchain network. It’s very different to crypto mining, which uses high-powered computers to solve complex mathematical equations.

Read more: What is crypto staking? | Staking made simple

Staking is a way to generate passive income without actively trading your crypto. It’s a means of putting your crypto ‘to work’, rather than leaving it sit idle in your wallet.

Liquid staking circumvents the lock-in period

Staking as an individual typically requires a lock-in period, whereby your crypto is locked into a smart contract and rendered illiquid.

This can be off-putting for investors who wish to retain liquidity, particularly given the volatile and speculative nature of many tokens.

This is where liquid staking comes in handy.

With liquid staking, users can stake their tokens and receive staking rewards, while still retaining the ability to transfer or trade their tokens.

This is achieved through a process known as tokenized staking, where staked tokens are converted into a representation of the staked tokens, known as a “staking derivative”. The staking derivative can be freely traded or used in decentralized finance (DeFi) protocols, while still earning staking rewards.

If you stake Ethereum on Binance, for instance, you’ll be able to freely trade BETH, which is pegged 1:1 with ETH, in lieu of your locked either.

Some of the biggest staking providers are Lido, Rocketpool and Marinade Finance, but there are many more.

What are the benefits of liquid staking?

The main benefit is that liquid staking gives users increased liquidity, flexibility, and the ability to access DeFi protocols while still earning staking rewards. Additionally, it can help increase the security and decentralization of the underlying blockchain network by encouraging more users to participate in staking.

At present, nearly 70% of all staked ETH has been staked through liquid protocols such as Lido and Rocketpool. The benefit of this is that most stakers retain liquidity, decreasing the chances of high selling pressure.

Read more: Ether (ETH) Price Eyes $2,000 as Shapella Upgrade Nears

Are there downsides?

Yes. With liquid staking, there’s a risk of impermanent loss, which is when the value of the liquid staking token diverges from the value of the underlying staked token. Stakers also run into additional fees when staking via liquid protocols, reducing the profitability.

In addition, liquid staking can also create governance issues, as the ownership of staked tokens may be spread across multiple parties. This can make it more difficult to achieve consensus and make decisions on behalf of the network.

Disclaimer: CryptoPlug does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.