Profits may be down, but adoption isn’t slowing. Let’s take a closer look at the numbers.

Last week, a new report spilled a gutful of negative sentiment into the NFT market, declaring 95% of NFT collections “worthless”.

95% is a huge number, but without context, it’s a slightly misleading one. A vast majority of collections have indeed lost value, but it’s the top 500 collections – the remaining 5% – that constitute the biggest bulk of value in the $11 billion NFT market.

CryptoPlug has reported on many occasions the NFT market is rapidly changing. It’s moving away from purposeless profile pictures (PFPs) toward a range of new NFT categories, including memberships, utility, gaming, sport and more. Over the past thirty days in particular, gaming and sport NFTs have outpaced BAYC and CryptoPunks in many measures, ranking in the top three spots on CryptoSlam.

Read more: NFT market closes in on the end of collectible jpegs, 95% have zero value

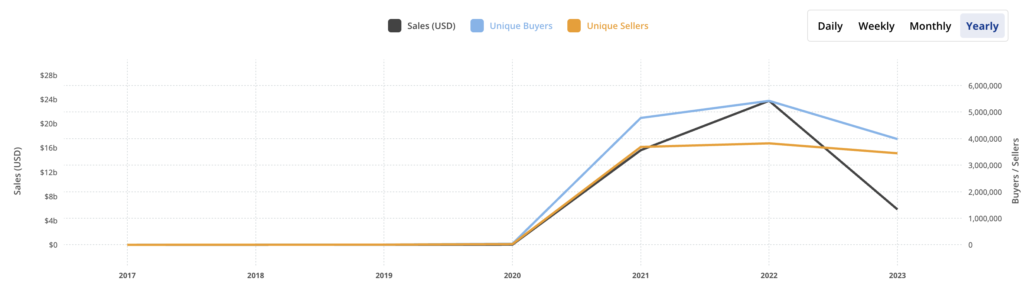

Let’s take a look at how the NFT market is faring today, compared with 2020 – the year that marked a turning point for NFTs in popular culture.

There are three key metrics that prove that the market is still very much the future: transaction volume, unique buyers, and global sales.

#1 Total transactions – +52,415%

This metric refers to the total number of transactions across all blockchains. Data from CryptoSlam shows that transactions have increased every year since 2020, even throughout the bear market of 2022 and 2023.

2020 saw just 130,979 total transactions – many of which were niche projects like CryptoKitties and Decentraland.

Fast forward to 2022, i.e. the thick of a crypto winter, and transactions increased to 54.8 million, an eye-popping jump of 41,692% from 2020.

This year we’ve seen another jump in transactions, despite still having another quarter of trading yet to unfold. There have been 68.9 million NFT transactions in 2023 so far: 25% more than last year, and 52,415% more than 2020.

#2 Unique buyers – +10,100%

In 2020, the NFT market demographic was extremely narrow, with just 39,022 unique buyers.

Within one year, this metric skyrocketed to 4.7 million, a jump of 11,956%. Unique buyers increased even further in last year, climbing to 5.4 million.

Today, this number has eased to 3.9 million, which is still a huge margin higher (10,100%, to be exact), than numbers seen in 2020.

It’s easy to see why investors have been comparatively deterred by the NFT market this year. Sentiment has been sour, regulators have been hostile, and the floor prices of some blue-chip projects crashed stunningly, leaving many investors at a loss. (The argument can be made however that these collections were overvalued to begin with).

Read more: Opinion: The SEC’s action against Stoner Cats is a new low, even for Gensler

While the number of unique buyers has slightly decreased this year, the NFT market demographic has increased in its diversity due to an increase in project variety. 51% of people who use NFT-backed metaverse games like Roblox, Minecraft and Fortnite for instance are under the age of 13, signalling wider industry adoption.

#3 Sales – +31,872%

Since 2020, the total number of global sales reported by CryptoSlam has increased by more than 31,000%, climbing from 18 million in 2020 to 5 billion in 2023.

Some of the biggest NFT sales recorded to date include Beeple’s “Everydays: The First 5000 Days”, which sold for $69 million at a Christie’s auction, and Pak’s “The Merge”, which sold for $91.8 million.

Sales such as these are rare though, and compared with last year, overall sales have declined, diving from 23 billion to 5 billion (-78%).

Average sale prices have also decreased since 2020, falling from $138 to $84. Poor market conditions are at play here, but so is the shift in collection demand. Sport and gaming NFTs, which are increasing in popularity, come with a far more modest price tag than blue-chip PFPs like BAYC, which currently holds a floor price of 24.19 ETH (approx. $40,000), skewing average prices lower in spite of increased adoption.

Profits are down, but sellers remain loyal

The bear bit the NFT market hard this year, and total trading profits have come in at a loss of -$276,334,552. This is a massive 64,999% decrease from the $423 million profits recorded in 2020.

Despite this, traders are unwavering in their commitment to the NFT market. Unique sellers have remained fairly consistent since 2021, hovering between 3.4 million and 3.8 million.

This is likely attributed to the surge in utility, sport and gaming NFTs, which offer users purpose and entertainment independent of market conditions.

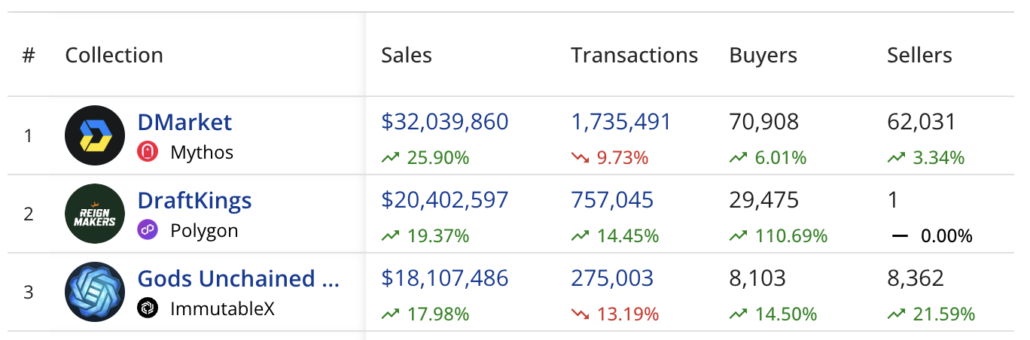

CryptoSlam data shows that the top three NFT collections in the past 30 days are game-based collections DMarket, DraftKings and Gods Unchained.

In contrast, blue-chip PFPs are sorely in red figures, with Bored Ape Yacht Club suffering the biggest drop in every metric.

Web3 moves at a dizzying pace, and it’s easy to forget how far the market has come in such a short space of time.

95% of collections may be worthless, but are such collections a genuine loss to the NFT ecosystem?

Probably not.

Disclaimer: CryptoPlug does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.