Bitcoin’s market dominance has reached a three-month high amidst a period of reduced volatility.

Bitcoin, the world’s first and largest cryptocurrency, has regained its market dominance this week, accounting for 51.35% of the market.

The shift indicates an increase in investor preference toward the pioneer crypto, particularly as altcoins such as ETH and BNB see declines.

Bitcoin’s market dominance has now reached a three-month high while it enjoys a period of relative price stability.

Related: Crypto volatility reached a new low in the 3rd quarter

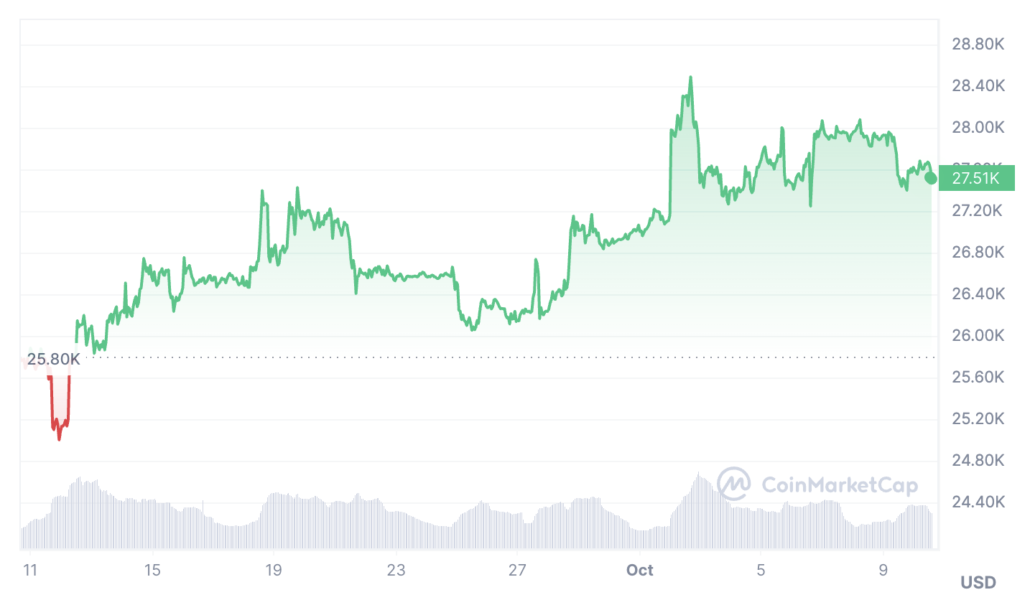

At the time of writing, Bitcoin (BTC) is trading at $27,511, a 0.1% decrease from last week.

Ethereum (ETH) on the other hand is trading at $1,580 – a 4.6% drop from the previous week. Other altcoins have also taken a hit, with Solana’s SOL losing nearly 8% over the past seven days.

The crypto ETF race has had a direct impact on the performance of many top cryptocurrencies.

For two years (June 2021-2023), Bitcoin’s market dominance fluctuated between 39% and 49%, but following BlackRock’s spot Bitcoin ETF application in June, dominance shot up to 52%.

Read more: Ether futures ETFs have a “pretty meh” first day of trading

The first Ethereum Futures ETFs debuted last week, but they had an unexpectedly lukewarm trading reception, which likely impacted the performance of the crypto. Commenting on the underperformance of the new Ether ETFs, Kaiko pointed toward the bear market, stating bear conditions historically see traders “turn to BTC, the oldest and largest crypto asset”.

It added, “ETH spot trade volume has also stayed mostly flat over the past two months, only spiking above $2bn a handful of times.”

The Ether-Bitcoin ratio has also slumped, dropping to 0.05675 on Monday, October 9.

Despite macroeconomic conflict, experts are hopeful that Bitcoin will enjoy a bullish trend over the coming weeks. A recent Coinshares report pointed to an increase in investment with a total of $78M entering the Bitcoin market over the past week – a 400% increase from the previous week.

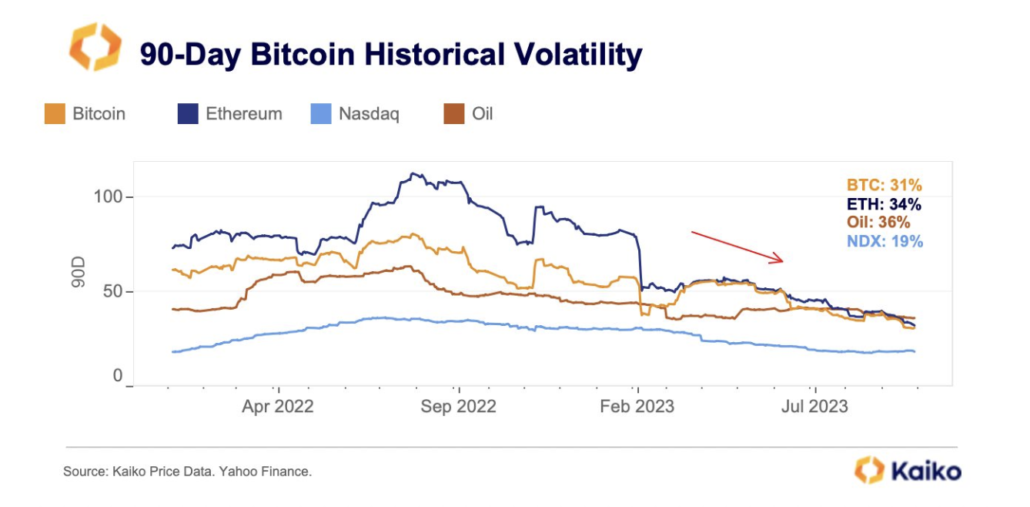

Crypto volatility has eased

A new report from Kaiko shows that volatility within the crypto market eased up in the third quarter of 2023, with volatility reaching its lowest point in several years. This suggests that digital assets are either experiencing dampened activity, or they’re reaching maturity.

Read more: Bitcoin this week: events to watch

Read more: Bitcoin starts October with a 5% surge — Happy Uptober?

Disclaimer: CryptoPlug does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.