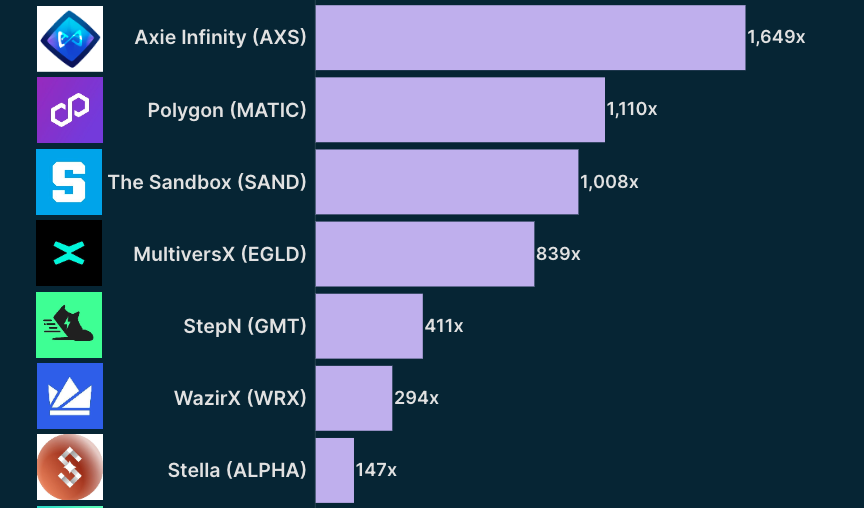

Investing in the right Web3 project at an early stage can bring investors returns of 1600x and beyond, a new CoinGecko report shows.

For many investors in the world of Web3, finding the golden goose that will give you 10x, 100x or even 1000x on your investment is the ultimate pursuit. The problem is, dozens of new projects launch every week, and 1 in 4 new tokens launched are scams, according to Chainalysis.

It’s hard to know what projects are legit and which projects are comprised of bad actors waiting to pull the rug, but a good place to start is with a registered and regulated platform, such as Binance Launchpad, which subject new projects to a strict vetting criteria.

As the name suggests, Binance Launchpad is a platform that facilitates the launch of new blockchain projects through token sales. It helps promising startups raise funds by offering their tokens to a global investor community, either through Initial Coin Offerings (ICOs) or Initial Exchange Offerings (IEOs).

Many investors will know that this seed phase is the most lucrative time to get in on a project, and it’s possible to see returns of 1000x or more when investing early enough in the right Web3 project.

Related: OpenSea breaks creator fee structure, makes royalties optional

New research conducted by CoinGecko sheds light on some of the most profitable ventures to emerge from Binance Launchpad, and the numbers are eye-popping.

Axie Infinity: 1649x

Axie Infinity is an NFT-based game on Ethereum with a play-to-earn model. Some regard it as the ‘OG’ of play-to-earn gaming.

Figures show that AXS, the native token of Axie Infinity, boasted the highest returns on Binance Launchpad since 2021. In the initial token sale, AXS listed for just $0.10.

By November 6, it surged to $164.90, a hike of 1649x, or 164,900%.

While the price of AXS has dropped back down to $4.81, the project holds a market cap of $632,806,901, and it’s still 4710% up from its launch price.

Polygon (MATIC): 1110x

The second highest earner after Axie Infinity was Polygon’s MATIC token.

Polygon is a blockchain that runs alongside the Ethereum blockchain. It’s a Layer 2 scaling solution (a sidechain) that provides an easy framework for blockchain projects to build on Ethereum without scalability limitations. It’s a key player in the mass adoption of the Ethereum network.

The Polygon network is secured by its native token, MATIC.

After launching on Binance Launchpad in 2019 with an initial token price of $0.00263, MATIC peaked at $2.92 in December 2021 – demonstrating returns of 1,110x, or 110,714%.

Read more: Polygon Explained | A beginner’s guide

The token currently holds a substantial market cap of $5 billion, despite the price of its token sliding back to $0.55.

Price aside, Polygon has grown to become one of the most widely used and trusted platforms in Web3, boasting $13.6 billion in NFT sales volume.

The Sandbox: 1,008x

The highest earner after Polygon was metaverse project The Sandbox, which generated returns of 1,008x for initial investors.

Read more: The British Museum to join Ethereum metaverse, The Sandbox

2022-2023: all seven new projects on Binance Launchpad generated positive returns

Despite a prolonged bear market, all seven projects that launched on Binance Launchpad from 2022 to 2023 generated positive returns, according to CoinGecko research. Each project fell within the range of 11x and 411x the initial investment at their peak. While the numbers are certainly cooler than the peaks seen in 2021, they evidence that value and investor confidence remains strong.

The most successful project to launch on Binance Launchpad in the past year was StepN (GMT). StepN is a unique Web3 ‘move-to-earn’ lifestyle app that rewards holders for physical activities such as walking and jogging. Its GMT token launched with an initial price of $0.01, reaching a peak of $4.11 by April 2022 – a healthy return of 411x.

The app now has 66,000 monthly active users on both iOS and Google Play, demonstrating a growing demand for apps that have real-world value and utility.

SpaceID (ID) and Hook (HOOK) also showed returns of 41x this year, again demonstrating strong investor confidence.

Related: ‘The Rekt Test’: the 7 questions all Web3 projects should be able to answer

A pattern has emerged in Web3: projects that have some form of utility have shown greater stamina than the first string of popular PFP blue-chip NFTs such as Bored Ape Yacht Club (BAYC), which are waning in both value and cultural significance.

Bored Ape saw its floor price slide 41% last month, and Azuki faced serious backlash after its long-awaited Elementals collection flopped, driving holders to sell for less than the mint price just hours after a disappointing post-mint artwork reveal.

The projects which generated the highest returns on Binance Launchpad over the past year didn’t rely on ‘hype’ and shilling: they blazed through the market with legitimate offerings beyond digital art, whether it’s StepN’s move-to-earn incentive or Arkham’s security offering.

As the industry finds its way out of a crypto winter fulled with catastrophic events like the collapse of FTX alongside regulatory aggression, it’s clear that digital assets are still more than able to hold their own.

Disclaimer: CryptoPlug does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.