Non-fungible tokens (NFTs) are unique one-of-a-kind digital assets that live on a blockchain. Every NFT has a unique identification code which cannot be copied, substituted or subdivided.

NFTs are often used to represent ownership of a physical or digital asset, similar to how a legal deed works.

Like cryptocurrencies, NFTs are generated by a blockchain. The key difference between cryptocurrency and NFTs is that cryptocurrencies are interchangeable, while NFTs are not.

To get a better understanding, let’s look at what we mean by the word ‘fungible’.

The OED defines the word ‘fungible’ (adj.) as “(of a product or commodity) replaceable by another identical item; mutually interchangeable.”

Fungible v non-fungible

The concept of fungibility doesn’t only relate to financial assets. Basketballs are fungible. If you break the ball, you can replace it with another identical ball. A barrel of oil is also fungible: if your barrel spills, you can replace it with the same oil without impacting its value.

Fiat and cryptocurrencies are also fungible assets. If you have two ten dollar bills, you can exchange them for one twenty dollar bill and have the same value. One bitcoin is also worth the same as any other bitcoin.

Concert tickets are an example of non-fungible goods. Each ticket has a unique barcode, so they are not interchangeable. Airbnb bookings are also non-fungible, since every listing is different.

Non-fungible tokens then are unique blockchain-verified digital assets that cannot be replicated or exchanged for something identical. Even if the artwork or object that comes with the NFT is exactly the same, the cryptographic token behind each piece is different.

What are they used for?

Throughout the NFT boom of 2021, the most popular NFTs represented ownership of digital artwork. There are many reasons why artists choose to sell their work through tokenisation rather than traditional publication, such as:

- The artist sets the price, as well as the percentage of royalties on secondary market sales on some marketplaces.

- Transactions are simpler and more efficient. Transactions are also immediate, and there is no middle hurdle of finding an agent or publishing house.

- The artist is in a direct transaction with the buyer.

Some of the biggest digital art sales include Beeple’s Everydays – The First 5000 Days collection, which sold for $69 million; Paks’ Merge collection, which sold for a whopping $91.8 million; and Grimes’ War Nymph collection, which sold for $6 million.

Here are some images from Beeple’s First 500 days collection.

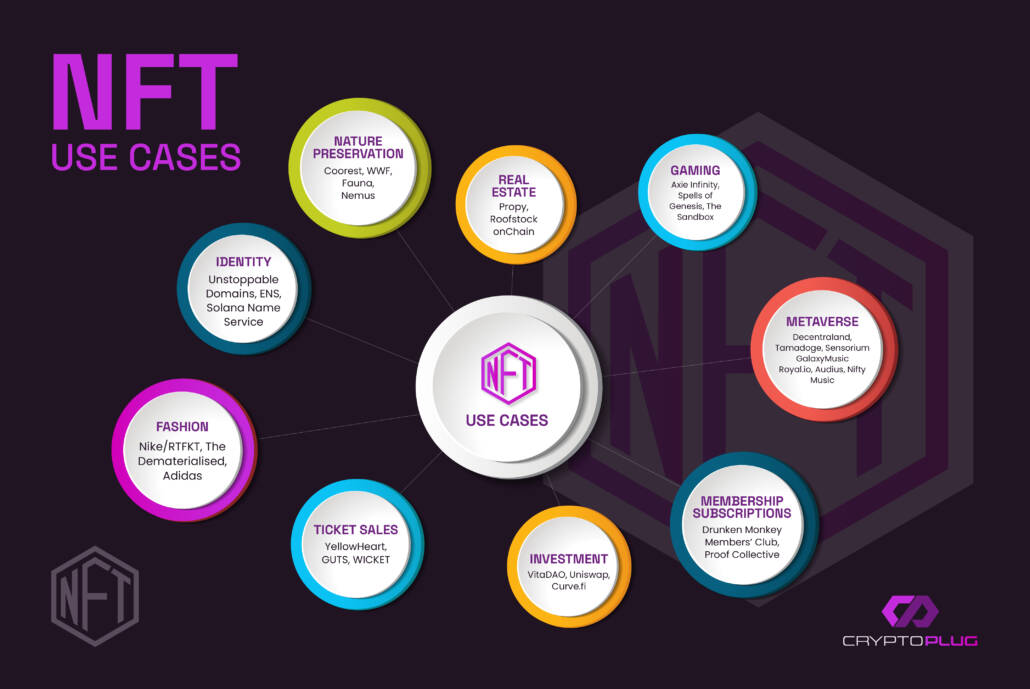

A growing number of NFTs come with perks and services that go beyond the artwork.

NFTs that have a function outside of the artwork are called utility NFTs. Some examples of utility NFTs include Drunken Monkeys’ Members Club, a project that grants NFT holders lifetime access to a luxury real-life concierge network, and Moss.Earth, a Brazilian utility project that gives NFT holders the opportunity to participate in the preservation of the Amazon rainforest.

Ethereum inaugurated the NFT boom of 2021

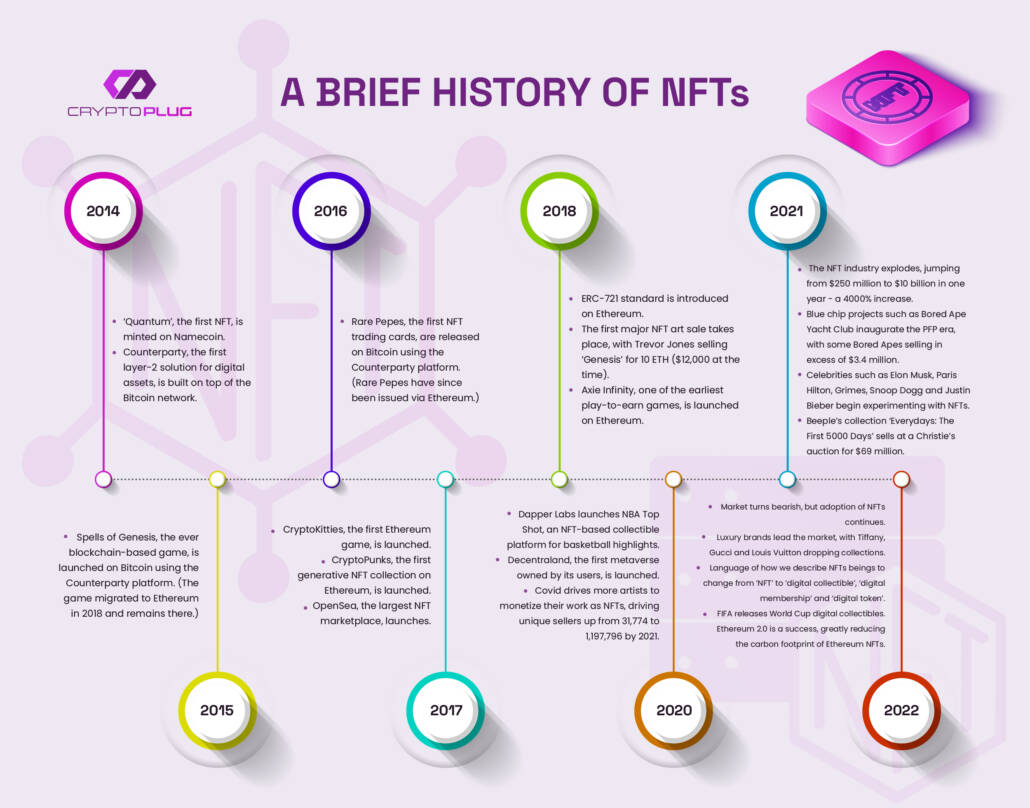

The first NFT was minted in 2014 on Namecoin. Several other NFT projects like Spell of Genesis (the first blockchain game) and Rare Pepes came shortly after, but the NFT industry remained extremely niche as they were difficult to trade.

That is, until Ethereum came along.

With its smart contract blockchain and secure data structure, Ethereum made it significantly easier to create, store and trade tokens, inviting a much wider demographic of traders to the NFT space. The first Ethereum NFTs landed in 2017, and by 2021, the industry was booming, inaugurating a new era in the digital world.

Other proof-of-stake blockchains such as Algorand, Cardano, Tezos and Solana have also developed highly active NFT ecosystems with thriving marketplaces such as Objkt, JPG.store and SolSea.

Ethereum however remains home to the blue-chip NFT.

A blue chip NFT is one that is expected to hold stable, long-term value. Blue chip NFTs tend to have a high floor price, utility, renowned branding and celebrity endorsements. Some of the biggest blue chip NFT projects on Ethereum as of 2022 were:

- Bored Ape Yacht Club – $1.57 billion

- Otherdeed – $1.1 billion

- Mutant Ape Yacht Club – $1.14 billion

- Azuki – $849.9 million

- CryptoPunks – $575.2 million

NFT History

NFTs are much newer than cryptocurrencies, but they share a similarly volatile history. The first NFT was minted in 2014, but the industry didn’t really kick off until 2017, which is when Ethereum-native projects such as CryptoKitties and CryptoPunks first launched.

2021 is widely considered to be the golden age of NFTs (so far, at least), which saw a fast 4000% increase in market value.

The benefits of non-fungible tokens

Less bureaucratic, more efficient

A key benefit to tokenizing physical assets such as real estate and commodities is that it simplifies the transaction process. Investing in property is notoriously bureaucratic, and buying a house or land can take years. NFTs are built on a peer-peer decentralised public network whereby buyers and sellers engage in direct transactions without agents and other intermediaries.

Authenticity and ownership integrity

NFTs are unique one-of-a-kind assets that cannot be replicated or subdivided. They are great vehicles for validating the authenticity and ownership of an asset or item, whether it’s a deed to a house or a piece of art. Blockchain technology can even be used to validate sensitive information such as health records.

The market is global

NFTs can be bought and sold from anywhere in the world, as long as there is an active internet connection (and possibly a VPN in some countries). This is beneficial for sellers as they can access a much wider audience and pool of potential buyers. This also means that sales are 24/7, independent of timezones and borders.

Immutable and transparent

A blockchain is a digital ledger that is permanent and non-editable, allowing for a clear, tamper-proof record of ownership and transaction history. Although personal information is not stored on a blockchain, all transactions are traceable through wallet addresses.

The drawbacks

The market is new and unregulated

Unlike mature stock markets, the NFT market is largely unregulated, leaving buyers vulnerable to hacks, scams and other illegal activities. Additionally, copyright laws surrounding NFT art are fairly undeveloped, which may bring future uncertainties for both creators and buyers.

Market volatility

As a new market, the value of NFTs can be extremely volatile, making it difficult for buyers to predict future markets. High prices are often driven by market hype and speculation, so it can be difficult to assess which projects are truly valuable. Low liquidity and price manipulation are also seen within NFT markets.