Cryptocurrency is a digital or virtual currency that uses cryptography to secure transactions. Unlike physical money, cryptocurrencies are not issued by a central authority such as a bank or reserve – they are generated by a decentralised computer network called a blockchain.

A blockchain is a highly secure digital ledger or database that records permanent, uneditable transactions. Rather than being confined to one location or entity, a blockchain is distributed across thousands of nodes (i.e. computers). As a distributed network, a blockchain is extremely difficult – if not impossible – to hack.

The decentralised nature of blockchain means that cryptocurrencies are theoretically immune from political and governmental interference. Cryptocurrencies are also impossible to counterfeit, and they cannot be double-spent.

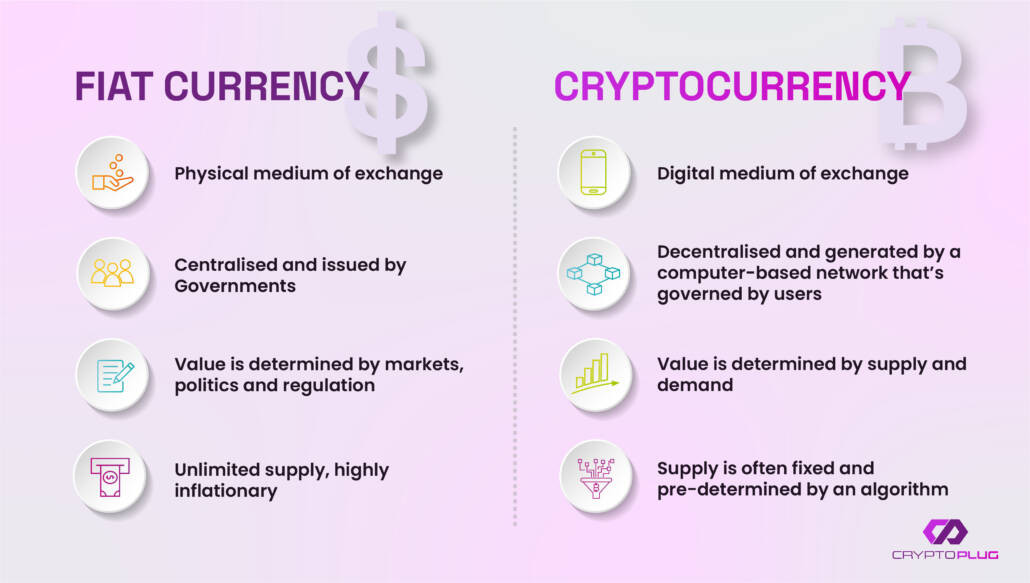

To understand cryptocurrency better, let’s take a look at the differences between fiat currency (i.e. government-issued money such as dollars) and cryptocurrency.

What can I do with it?

Bitcoin was created as a store of value to be used in everyday transactions, from buying a coffee to investing in property. In fact, the first commercial bitcoin transaction was a Papa John’s pizza purchase in 2010. Laszlo Hanyecz paid 10,000 BTC for the pizzas (roughly $41 at the time). 10,000 BTC today would be worth in excess of $500 million.

Mass adoption of bitcoin as a currency has been slow, but adoption is well underway. An increasing number of companies now accept bitcoin as a payment, including Wikipedia, Microsoft, AT&T, PayPal and more. Countries including El Salvador and the Central African Republic also recognise bitcoin as legal tender.

Adoption aside, cryptocurrency is a great way to execute fast, low-cost transactions. In September 2021, a $2 billion transaction was processed at a fee of just $0.78. A transfer of this size in fiat currency could take as long as a week, with substantially higher fees.

You can also stake some cryptocurrencies to generate a passive income.

When you stake your crypto, you effectively lock up your cryptocurrencies on the network for a period of time to earn a reward. This reward incentivises participation in operating the network. Some of the best staking coins are ETH, SOL, XTZ, BNB, DOT, ATOM and MCADE.

What are some examples of cryptocurrency?

The first and most valuable cryptocurrency is bitcoin (BTC). Bitcoin is known for its volatile price history. The first bitcoin traded for $0.0008 in 2010, but by 2021, it soared in excess of $65,000. It currently trades at around $21,700.

Ethereum (ETH) is the second largest cryptocurrency by market cap, but the network itself is very different from Bitcoin. Ethereum is a smart contract platform that can support decentralised apps, NFTs, games and more.

The third largest cryptocurrency is USDT, a stable coin that’s algorithmically pegged to the US dollar. USDT is closely followed by BNB, USDC, XRP, BUSD, ADA, DOGE and MATIC.

You can find live prices of the top 20 cryptocurrencies here.

How does it work?

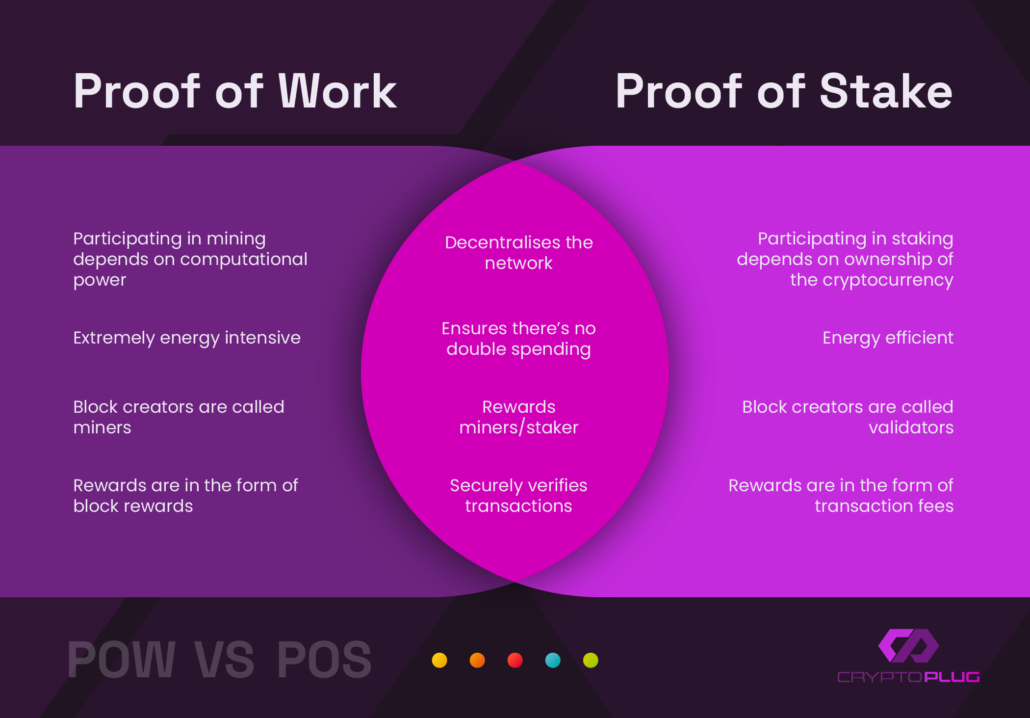

There are two main ways of verifying transactions on a blockchain – proof-of-stake and proof-of-work. They work in different ways, but they both have the same function.

A proof-of-work consensus mechanism uses large amounts of energy from a network of computers to verify transactions and add blocks to the chain. It’s the first type of protocol and it’s used by Bitcoin, Bitcoin Cash, Monero, Dogecoin, Litecoin.

The process of verifying transactions on a proof-of-work blockchain is called mining. Crypto miners use computer energy to solve arbitrary, complex cryptographic mathematical puzzles. When solved, the block is verified and added to the chain, and the miner is rewarded with a predetermined amount of cryptocurrency. For Bitcoin, the block reward is 6.25 BTC (approx $134,000 USD), but this reward will drop to 3.125 in 2024. The process is highly competitive, driving miners to join vast mining pools to increase their chances of solving a puzzle.

In a proof-of-stake consensus, cryptocurrency holders stake their coins as collateral for a chance to become a validator. Validators participate in consensus by authenticating the legitimacy of new blocks. Unlike miners, validators are selected at random, making the process less competitive. Proof-of-stake uses significantly less energy than proof-of-work.

Validators also receive rewards for their stake in the form of transaction fees. Blockchains that use proof-of-stake include Ethereum, Cardano, Algorand, Tezos, Solana and Polygon.

There are variations of proof-of-stake including:

- Liquid proof-of-stake (LPoS), which is used by Tezos. LPoS is a highly flexible staking structure that has no fixed number of block producers.

- Pure proof-of-stake, which is used by Algorand. Pure PoS selects validators secretly and randomly, improving decentralisation.

- Proof of stake with proof-of-history, which is used by Solana. Proof-of-history verifies the order and passage of time between events to improve the efficiency of proof-of-stake.

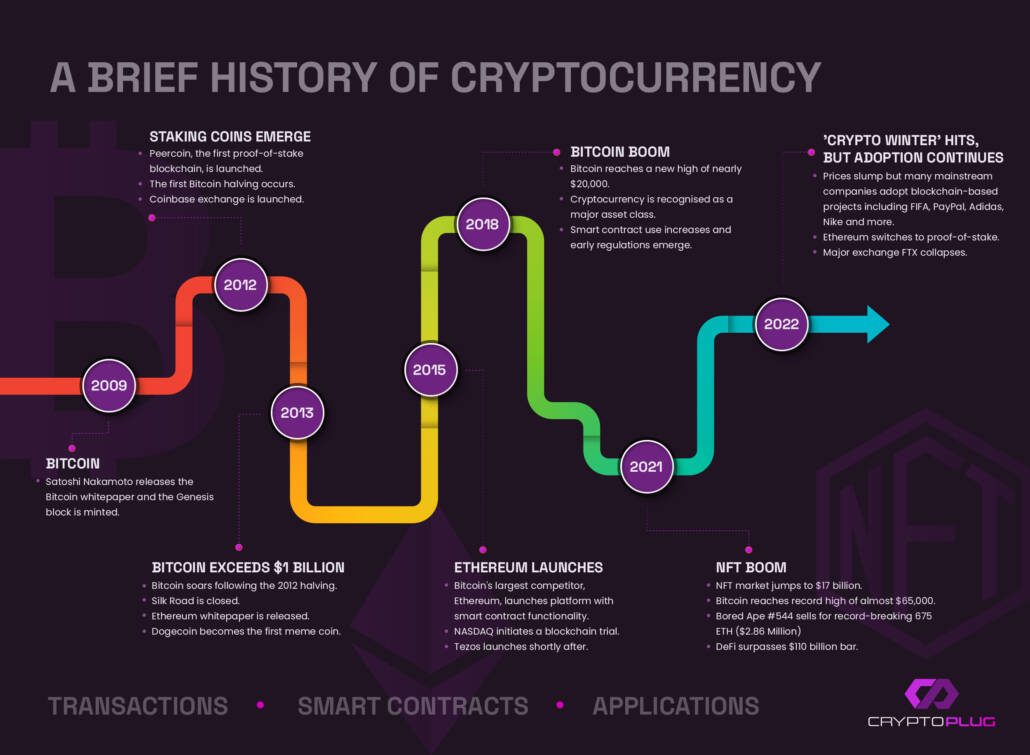

Crypto history

Cryptocurrency is one of the most volatile asset classes. Huge gains can be followed by huge losses, and vice versa. As a new market, unexpected events happen frequently – summed up most clearly in the collapse of the major exchange, FTX.

Here’s an overview of the major developments that have taken place in the crypto world over the past 14 years.

Advantages of cryptocurrency

- Blockchains are highly secure

- The network is decentralised

- Unique passive income opportunities through staking

- Public blockchains such as Bitcoin are very transparent

- Potential inflation hedge on fixed-supply coins such as bitcoin

- Asset diversification

- Fast, easy, low-cost financial transfers

Disadvantages of cryptocurrency

- Poorly regulated compared with fiat currency

- It’s very difficult and sometimes impossible to fix transfer errors

- Hacks and phishing scams are common

- Proof-of-work mechanisms are incredibly energy intensive

- Market volatility

- Mass adoption hasn’t been achieved yet