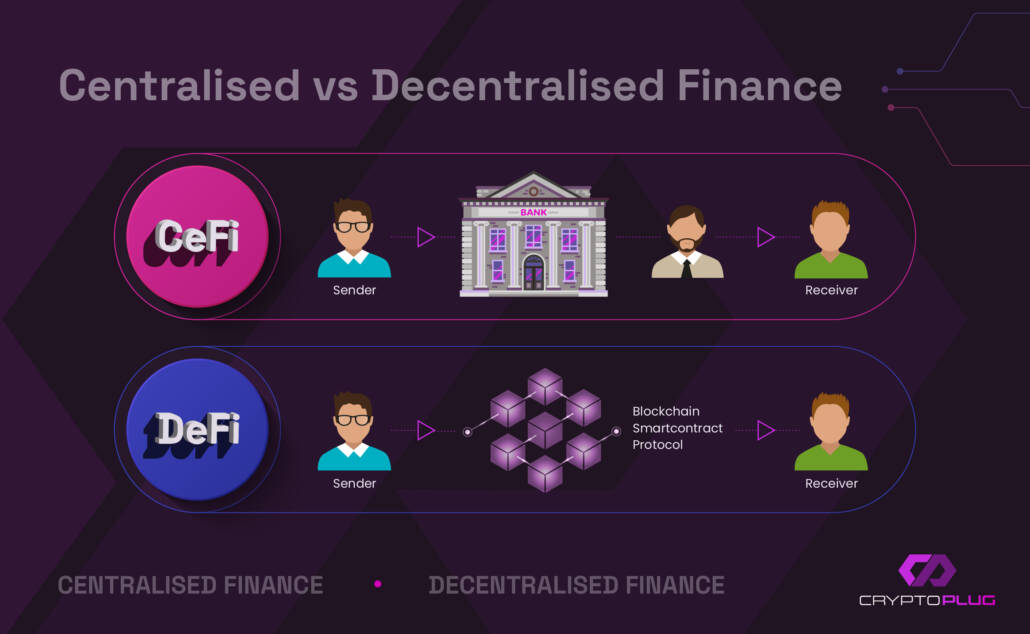

Decentralised finance (DeFi) is a growing financial technology that enables individuals, institutions and businesses to access capital and financial services through public blockchains rather than centralised banks. A blockchain is a peer-peer public ledger that records a highly secure, permanent history of uneditable transactions. DeFi, based on a peer-peer network, eliminates third parties and other intermediaries from the transaction process, enabling A to transact directly with B without C’s approval or oversight.

To understand DeFi, it’s important to have a basic understanding of

centralised finance. Within a centralised financial system (i.e. the traditional banking system we all use), all financial services are managed and controlled by intermediaries such as central banks, private commercial banks and financial committees. In every centralised transaction, the institution moving your money from one party to the other will charge a fee for doing so – whether you’re buying a house, applying for a loan, or using simple everyday banking features.

If you use your credit card to buy groceries at the supermarket, your financial provider has the power to view, control and block the payment, and to record the transaction in its private database.

While centralised financial transactions are overseen by human gatekeepers offering users little to no direct control over their finances, decentralised financial transactions are ‘permissionless’, meaning they do not require manual authorisation (i.e. they are powered by automatic smart contracts).

Fees aside, centralised financial institutions such as lenders and credit unions collect personal financial information and share it with further intermediaries such as insurance and marketing companies. The aggregation of your personal financial data is then deduced to a credit score that assesses your ‘creditworthiness’.

What can we use DeFi for?

There are many Dapps (decentralised apps) supporting DeFi already, with Ethereum leading the way. DeFi can be used for pretty much anything that the traditional financial structure offers, from sending and receiving money to taking out loans. The key difference is that the DeFi ecosystem trades in cryptocurrencies that are stored in secure digital wallets, rather than bank accounts.

1. Decentralised exchanges (DEX)

A DEX is a cryptocurrency exchange that has no central authority or intermediary. Unlike centralised exchanges, such as Binance, Kraken and Coinbase, decentralised exchanges operate via a peer-peer blockchain network, enabling users to transact directly with each other. Popular DEXs include Uniswap, PancakeSwap and SushiSwap. Many traders prefer to use a DEX rather than a CEX because they have lower fees and greater security measures, since they are non-custodial.

2. DAOs

A DAO is a blockchain-based decentralised autonomous organisation that uses immutable smart contracts to execute functions. Like a DEX, a DAO is distributed across a blockchain network that eliminates central control and authority. DAOs are typically funded by its own token/cryptocurrency and governed by its members. Each member within the DAO can propose and vote on rules and operations within the organisation, and voting power is typically proportional to the members’ stake within the DAO.

Popular DAOs include Uniswap, Decentraland and BitDAO,

3. Lending and borrowing

DeFi applications enable users to lend and borrow cryptocurrencies without applying through a bank or other finance companies. Instead, DeFi borrowing and lending is automated through smart contracts that enable individuals to transact directly with one another. Because of this, DeFi lending and borrowing platforms tend to have lower interest rates than traditional financial institutions.

One of the most popular DeFi lending and borrowing platforms is Aave, which allows users to lend and borrow a wide range of cryptocurrencies. Another popular platform is Compound, which uses an algorithm to determine interest rates and automatically adjusts them based on supply and demand.

While DeFi lending and borrowing has its advantages, such as increased control over personal finances, market volatility means they carry greater risk.

4. Stablecoins

As the name suggests, a stablecoin is one that’s designed to maintain a stable value. Stablecoins are typically pegged to stable assets such as fiat currency or gold, and they are essential in helping the DeFi ecosystem overcome volatility. There are four types of stable coin, namely:

1. Fiat-backed coins are tied to fiat currencies such as the dollar or euro. These are backed by actual reserves of a fiat currency that’s audited to ensure the stablecoin is fully collateralised. Examples include Tether (USDT), USD Coin (USDC) and TrueUSD (TUSD).

2. Commodity-backed coins are pegged to the value of real commodities such as gold or oil. These commodities are verified through regular audits and examples include Paxos Gold (PAXG) and Digix Gold (DXG)

3. Algorithmic coins maintain stability through complex algorithms and smart contracts without the need for collateral such as gold or dollars. The algorithm adjusts the supply of the token based on market demand and examples include Ampleforth (AMPL) and Basis Cash (BAC).

4. Crypto-backed coins are collateralised by other cryptocurrencies, typically Ether (ETH) or Bitcoin (BTC). The stablecoin’s value is maintained through over-collateralization, where the value of the collateral is higher than the value of the stablecoin. Examples of crypto-backed stablecoins include Dai (DAI) and BitUSD (BITUSD).

5. Insurance

One of the most unique aspects of DeFi is its approach to insurance. DeFi insurance is entirely peer-peer and automated, with smart contracts acting as insurance policies. The smart contracts are programmed to automatically pay out claims to users in the event of a specific pre-defined event, such as a security breach or a hack. DeFi insurance is cost-effective with quick payouts, but as a new industry, there are some risks involved, such as poor liquidity.

6. Wallets

DeFi wallets are used to store, send and receive crypto funds and assets. Not all cryptocurrency wallets are DeFi wallets. Exchange wallets, such as Binance, are controlled through centralised entities that act as the custodian of the user’s assets. Popular DeFi wallets include MetaMask, Ledger Live and Trust Wallet. They are non-custodial, giving users full control over their private keys and funds. DeFi wallets are extremely secure, but the burden of responsibility is wholly on the user. If a private key (a password) is lost, the funds can be permanently lost.

Advantages of DeFi

1. Borderless transactions improve accessibility to finance.

More than one billion people remain unbanked – mostly people living in rural areas. DeFi allows anybody with an active internet connection to access financial services without having a traditional bank or credit history.

2. Blockchain technology is incredible secure and transparent.

A blockchain is a highly secure digital ledger. As a distributed network, blockchains are incredibly difficult to hack, and transactions are public and immutable, reducing the risk of fraud and corruption. In addition, the terms of a smart contract are self-executing, further reducing the risk of fraudulent or corrupt activity.

3. Low fees.

DeFi transactions are peer-peer, eliminating third party intermediaries. Because of this, many DeFi applications such as insurance have substantially lower fees than traditional financial services.

Challenges with DeFi

1. The market is highly volatile.

DeFi is underpinned by cryptocurrency rather than fiat currency. Cryptocurrencies are a highly volatile asset class that can lead to big losses for investors. Since DeFi is still in its early stages, liquidity may also be limited.

2. It’s fairly unregulated.

DeFi is a new, emerging financial sector that’s still largely unregulated. A lack of regulation can be off-putting for investors. DeFi is also very different to traditional finance, limiting adoption for non-internet native generations.