Sales may have slumped in 2023, but broader adoption continued. Let’s look at how this year closed the door on one era in NFTs to make space for a new, better one.

We entered 2023 in the thick of a bear market. While all sectors of Web3 struggled, NFTs were particularly hard hit. At one point, reports indicated that 95% of NFT collections were quite literally “worthless”, and the floor prices of some of the most valuable blue-chip collections crashed stunningly.

Nonetheless, despite low sales volumes and plummeting floor prices, broader adoption only continued, and NFT applications became more diverse.

Several leaps of innovation were also made this year through developments like Bitcoin Ordinals, which paved the way for new token standards such as BRC-20 and SPL-20.

Related: 3 key metrics that show NFTs are still the future

Let’s take a look at some of the most notable changes that took place in the NFT market this year.

Inscriptions dominated the market

In January 2023, a software developer by the name of Casey Rodarmore introduced the concept of Bitcoin Ordinals, marking a significant evolution in Bitcoin’s otherwise limited capabilities.

Ordinals inscribe data, such as images or text, onto individual satoshis, Bitcoin’s smallest unit. While Ordinals are technically not NFTs, every Ordinal is a unique digital artefact that is not interchangeable with an equivalent unit. A key difference between Ordinals and NFTs is that Ordinals inscribe data directly onto the blockchain, whereas NFTs use smart contracts to represent ownership of the asset.

Already, there are 52 million Ordinal inscriptions on Bitcoin, a Dune Analytics dashboard shows, reflecting rapid growth.

The first half of 2023 was particularly fruitful for Ordinals. In the second quarter of the year, the trading volume of Ordinals amounted to approximately $210.7 million, marking a drastic increase from the $7.18 million recorded in the first quarter.

Throughout December, the sales volume of Bitcoin Ordinals doubled that of Ethereum NFTs, boasting $819 million in total sales. Some of the most popular Ordinals on marketplaces such as OKX include Bitcoin Frogs, Bitcoin Punks and bitmap.

Bitcoin miners have greatly benefitted from Ordinals this year, raking in more than $215 million in transaction fees. This does however point to a common criticism of Ordinal inscriptions, which is that they unnecessarily take up block space and drive transaction fees higher for all Bitcoin users.

Domo and BRC-20

In March 2023, another developer known as “Domo” took Ordinals a step further and introduced the BRC-20 token standard. The BRC-20 standard utilises the unique identification system of Ordinals to create, mint, and transfer fungible tokens on the Bitcoin blockchain.

It’s akin to Ethereum’s ERC-20 standard, except on Bitcoin.

The first BRC-20 token, Ordi, launched in March 2023. The token reached an all-time high of $81.34 on December 26, and it now holds a market cap of $1.5 billion.

Read more: What is ORDI, and why is it surging right now?

There are now over 400 BRC-20 tokens, including memecoins like Wojak and Pepe.

The SEC tried (and failed) to strangle the market

2023 was the year the SEC cracked down hard on crypto. The Commission led high-profile lawsuits against Web3 giants like Binance and Coinbase, accusing both of selling unregistered securities.

The SEC has still not unanimously determined whether cryptocurrencies constitute securities, per the Howey test, but SEC Chairman Gary Gensler has frequently commented that crypto exchanges must comply with existing securities law, particularly for staking coins such as ETH, ADA, SOL, MATIC, alongside 60 others.

In the summer of 2023, the SEC took this stance even further and engaged in its first enforcement action against various NFT projects, accusing them of selling unregistered securities.

Related: SEC charges media company with selling NFTs as securities in landmark case

The first action was against Impact Theory, a wellness-focused podcast studio and YouTube channel co-founded by Tom and Lisa Bilyeu. The SEC ruled that the NFTs offered and sold to investors by Impact Theory were investment contracts and therefore securities.

Impact Theory agreed to a cease-and-desist order ordering it to pay $6.1 million in disgorgement, prejudgment interest, and a civil penalty. The order also established a ‘Fair Fund’ to return funds to injured investors.

Shortly after Impact Theory came an enforcement action against Stoner Cats – an animated show about house cats that become sentient after being exposed to their owner’s medical cannabis. The show had a star-studded cast featuring Mila Kunis, Ashton Kutcher, Jane Fonda, Chris Rock, and even Ethereum co-founder, Vitalik Buterin.

Uniquely, the show was funded by an NFT sale, whereby holders gained exclusive access to the series.

Read more: Opinion: The SEC’s action against Stoner Cats is a new low, even for Gensler

Similar to Impact Theory, the SEC charged the company behind Stoner Cats with selling NFTs as unregistered securities, slapping them with a $1 million fine. The SEC argued that the marketing of Stoner Cats misled investors into believing the value of their NFTs would appreciate significantly on the secondary market, in part because of advertisements featuring popular celebrities.

Commissioners Hester M. Peirce and Mark Uyeda strongly dissented on both cases, arguing the decision was unfair, arbitrary in its application, and stifling to creators. Both Commissioners gained a reputation throughout 2023 for supporting the innovation of Web3 in the face of adversity.

Related: “Crypto mom” SEC Commissioner dissents on landmark NFT case

OpenSea lost its dominance and disrupted creator royalties

OpenSea may have been the first and largest NFT marketplace, but throughout 2023, it lost a substantial portion of its market dominance to Blur.

Blur first launched in October 2022, and to compete with OpenSea, it offered users lower transaction fees, removed royalty enforcements and targeted Ethereum whale traders to drive up sale volumes.

By February, Blur was processing significantly higher trading volumes than OpenSea, primarily because of Ethereum blue-chips. On February 20, Blur processed a sales volume of $98 million, while OpenSea processed $18 million. On December 27 – yesterday – Blur still boasted a significantly higher daily volume of $15 million compared with OpenSea’s $2.8 million, per DappRadar data.

OpenSea still however retains the largest user base, hosting collections across 10 different blockchains.

Blur tore through the market so quickly in 2023 that on August 18, OpenSea announced that it will stop enforcing creator royalties, likely to try and recapture some of the market back from Blur. The move sparked caused industry-wide backlash from NFT creators who depend on royalty income.

Data shows that Yuga Labs lost around $20 million in royalties, which is likely why the company teamed up with Magic Eden to launch its own NFT marketplace.

The move did however drive up sales volumes on smaller platforms like Rarible, which reinforced its commitment toward NFT creator royalties.

Read more: OpenSea breaks creator fee structure, makes royalties optional

Another NFT marketplace that gained significant traction throughout 2023 is OKX. On December 18, OKX NFT Marketplace recorded a staggering 7-day trading volume of $325 million, data from DappRadar shows.

This surge positioned the platform as the largest NFT marketplace by daily trading volume, outpacing Blur, Magic Eden, UniSat and OpenSea.

Activity on OKX was notably higher than its competitors due to the rise of interest in Bitcoin Ordinals – which Blur and OpenSea have not yet capitalised on.

Floor prices crashed, but adoption increased

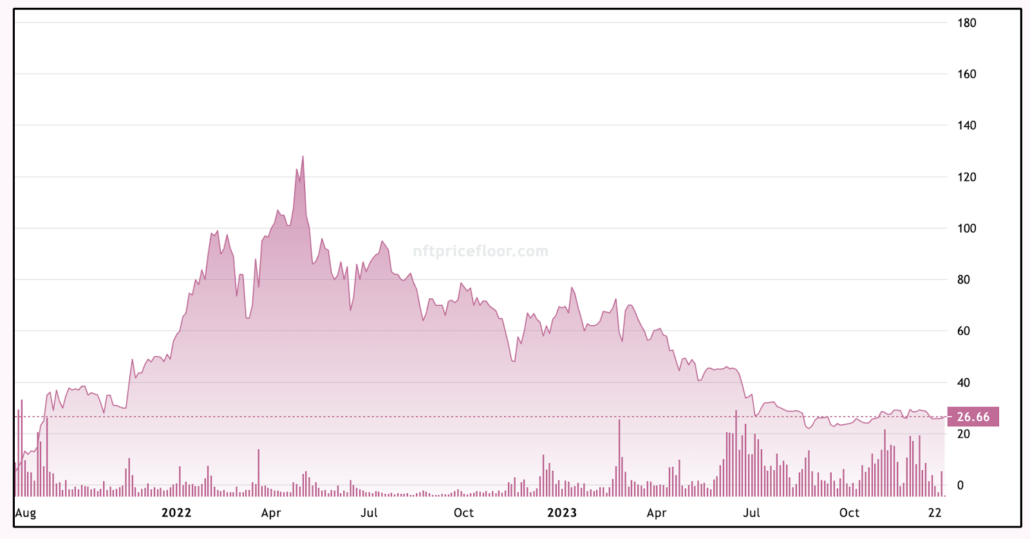

2023 was a rocky year for Ethereum blue-chips such as Bored Ape Yacht Club (BAYC), Azuki and CryptoPunks.

In April 2023, BAYC held a stunning floor price of 128 ETH, but today the floor price is substantially lower at 26.6 ETH.

CryptoPunks similarly has seen a substantial decline, though not as steep, dropping from 80 ETH in July to 55.7 ETH today.

Contributing to this decline is the oversupply of NFT projects with low quality and poor utility. While projects such as BAYC offer holders perks such as merchandise, occasional events and gated community access, these perks have not been sufficient to maintain high valuations in a market that’s increasingly discerning about utility and innovation.

The rise of Ordinals also undoubtedly captured the attention of investors who shifted their efforts toward staying ahead of the market with emerging trends.

Adoption continued, and applications diversified

NFTs saw huge adoption by Web2 brands this year, including Fifa, Starbucks, Ralph Lauren, Gucci, Adidas, The British Museum, and many more. Use cases also extended far beyond JPEGs and gated communities, with some projects offering digital concierge services, ticketing, luxury goods offerings, museum and gaming experiences, and beyond.

Related: Adidas announces first-ever NFT artist residency project

One of the most successful adopters of NFTs in 2023 was Fifa. Fifa’s Algorand-powered NFT platform, Fifa+ Collect, has accumulated 34 million ALGO in volume across 1 million transactions. Tezos similarly exemplified adoption with its new partnership with the Musée d’Orsay, marking a huge embrace of digital NFT art by the traditional art world.

There were still some notable gainers on the Ethereum blue-chip market, though.

Pudgy Penguins, a collection of 8,888 Penguin-themed NFTs that launched in 2021, saw its floor price more than double from 4.7 ETH in January to 10.9 ETH in December.

While the floor price is still fairly modest compared with legacy blue-chips like BAYC and CryptoPunks, the pace of growth is impressive in the context of broader market conditions.

2024: what to expect?

Many investors have had their eyes fixed on 2024 for the better half of two years, namely because it’s a halving year.

During the Bitcoin halving, the rewards miners receive for validating blocks is cut in half, slowing the supply of new Bitcoins. Historical price charts show that the price of Bitcoin tends to gradually increase after halving events, reaching new all-time highs the year after. This may be significant for NFTs, since the broader crypto market tends to move in tandem with Bitcoin.

Additionally, many analysts have expressed optimism that the SEC will approve the first batch of spot Bitcoin ETFs in the first few weeks of January, including applications from giants like BlackRock and Fidelity. While approval isn’t guaranteed, it would be a huge leap forward for the institutional adoption of Bitcoin, which will likely drive price upward.

Read more: What does Barry Silbert’s departure mean for Grayscale’s spot Bitcoin ETF application?

2023 showed strong sings of recovery and adoption in the NFT market, but it also showed that the golden days of the profile picture era, spearheaded by legacy blue-chips like BAYC, are potentially over. This is reflected in the sustained decrease in project valuation, which suggests they may have been overvalued to begin with.

Moving into 2024, it’s likely that the NFT market will evolve towards greater utility and integration within broader digital ecosystems, based on current trends. The focus may shift from scarcity and collectability towards NFTs with real-world applications, such as ticketing, gaming, real estate, memberships, and digital identity.

Based on the roadmaps of smart contract platforms such as Cardano, Algorand and Tezos, there could be increased emphasis on community-driven projects and NFTs with governance or participation rights in decentralised platforms.

Disclaimer: CryptoPlug does not recommend that any cryptocurrency should be bought, sold, or held by you. Do conduct your own due diligence and consult your financial advisor before making any investment decisions.